Trump Wins and Investors Follow the Herd

Here comes President Donald J. Trump.

Now that’s something you don’t see every day.

By now, the world knows all about the remarkable election results. To say that most so-called “experts” were wrong about the outcome is to be as generous as one can possibly be.

This is especially true of so many so-called market experts, most of whom had predicted a Hillary Clinton victory and probably invested accordingly.

We know that because of how the markets reacted on election night, especially as it was growing increasingly clear that Donald Trump could actually become the 45th U.S. president. I was watching the futures markets that night, and at one point the Dow futures were down more than 800 points. That shows traders were betting on markets falling hard on the Trump win.

Well, once again, the experts were wrong. On Wednesday, stocks opened somewhat erratically. But by mid-morning, there was a decided bid higher in the markets. That bid was driven by money flows into what I call “Trump-win” sectors. Those sectors are the ones likely to do well because of President Trump’s policies.

This rotation was even more pronounced given the fact that Republicans hold control of both the House and the Senate. The all-Republican executive and legislative branches mean that President Trump will be able to pass legislation he and the Republicans in Congress want, and that means he can enact proposals such as more infrastructure spending, corporate and personal tax cuts, removal of onerous regulations on business, increased defense spending, etc.

Wall Street liked that possibility, and on Thursday the big rally continued. The chart here of the Dow over the past five days tells you all you need to know about the initial feelings toward the election results.

This outcome was the exact opposite of what many thought would happen.

Last week, I read multiple research reports predicting a Clinton victory, and a rebound in the markets once certainty returned to Wall Street. These same reports warned that if Trump somehow pulled off a miracle upset win, then stocks would plunge, gold would surge and bond prices would spike.

The reality here could not have been more wrong.

Stocks surged after Trump’s win, gold prices fell and bond yields spiked. So much for the conventional wisdom.

One reason the markets have done so well over the past several days is due to the phenomenon of behavioral economics. This is when a group of actors (such as investors) behave along with one another and thereby fuel the action and/or result in a particular direction.

In this case, investors ran to sectors such as financials, biotech, infrastructure, defense and other sectors. While I understand this happens all the time on Wall Street, I caution you not to fall into this trap. What you don’t want to do is chase sectors, so I recommend not trying to ride the gains of the past two days in biotech, financials and other sectors on this immediate post-Trump-win boost.

Sure, if you were lucky enough to have owned these sectors before their big, respective moves, then congratulations. But if you try to pile in now, well, that’s likely to result in something I call “bad trade location,” and I recommend you avoid putting yourself in that position.

Of course, the Trump administration and the Republican Congress will mean new opportunities for investors. But if you succumb to the temptation to jump on a short-term buying wave, you just might see that wave fold in on you quicker than you think.

If you’d like to get in on the uptrends that are just starting to break out and avoid those that are destined to bring you to a bad trade location, then I invite you to subscribe to my Successful ETF Investing advisory service, today.

***Publisher’s Note***

I am happy to announce that Mike Turner has joined the Eagle Financial Publications family. Mike and I sat down for a short discussion about investing that you can listen to by clicking here now.

In this interview, you will get to know Mike better and learn a few other things, such as:

- Why most people buy and sell stocks at the wrong time

- Mike’s 10 Rules for Investing that everyone should know

- Why Bloomberg put Mike’s investing “Tools” product on more than 330,000 of its computer terminals

- And lots more!

Listen to Mike’s insights on the markets by clicking here now.

ETF Talk: Fund Offers Exposure to Africa

As we round out our list of regional emerging markets exchange-traded funds (ETFs), this article features VanEck Vectors Africa Index ETF (AFK), a fund that tracks many Africa-based companies and invests most of its $68 million total assets in those companies.

Africa likely is a relatively untapped region for most investors, even though it offers vast commodity resources and growth potential. In fact, as far as ETFs go, AFK is almost the sole choice for broad, pure-play African coverage.

ARK offers one-stop access to a broad range of sectors and African countries, including exposure to some less traditional markets. The fund screens both local listings of companies that are incorporated in Africa, as well as companies outside of Africa that generate at least 50% of their revenues within that continent.

AFK’s index focuses on Gross Domestic Product (GDP), rather than market cap like many other emerging market ETFs. This puts an emphasis on the economic well-being of the country where a selected company is based. As a result, small- and medium-capitalization public companies often are included in the fund.

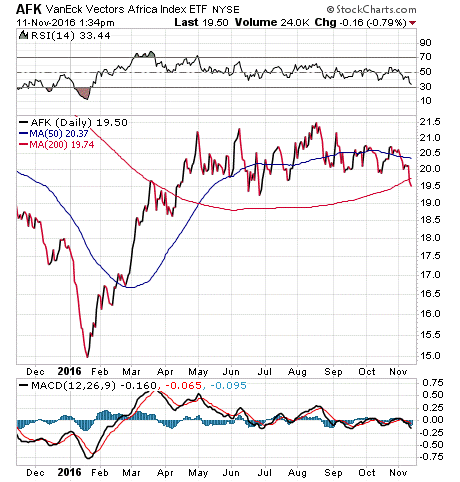

Year to date, AFK has enjoyed moderate success, with an 11.91% return versus the S&P 500’s 5.48%. Even though the fund is diversified, in the sense that it stretches over many sectors and firms, it is considered relatively high-risk due to the large number of small and medium caps in its holdings and the less politically stable nature of Africa compared to other regions. As you can see in the following chart, the fund has managed a small positive overall trend, but not without frequent ups and downs. AFK has a dividend yield of 1.89% and an expense ratio of 0.79%.

View the current price, volume, performance and top 10 holdings of AFK at ETFU.com.

The fund’s top five holdings are: Commercial International Bank (Egypt) SAE GDR, 7.92%; Naspers Ltd Class N, 7.42%; Guaranty Trust Bank PLC, 5.21%; Nigerian Breweries PLC, 4.65%; and Safaricom Ltd, 4.20%. AFK has 37.5% of its assets in the financial sector, 14.6% in materials, 11.7% in telecommunication services and 12% in consumer luxury goods. All of these sectors could flourish with strong growth of Africa’s economies.

If you want one-stop access to growing Africa-based companies and you believe in the strength of African economies in the long-run, consider looking into VanEck Vectors Africa Index ETF (AFK) as a possible future addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

Wisdom for Trump

“I count him braver who overcomes his desires than him who conquers his enemies; for the hardest victory is over self.”

— Aristotle

It might be presumptuous of me to offer advice to the president-elect, but the wisdom here from Aristotle applies to all humans. In a job that will no doubt test the limits of human will, it is wise to have control over your own desires and impulses. If you can achieve this, the country is likely to be the real victor.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about what I felt the best way to invest after the election would be.