The Trump Equity Rotation

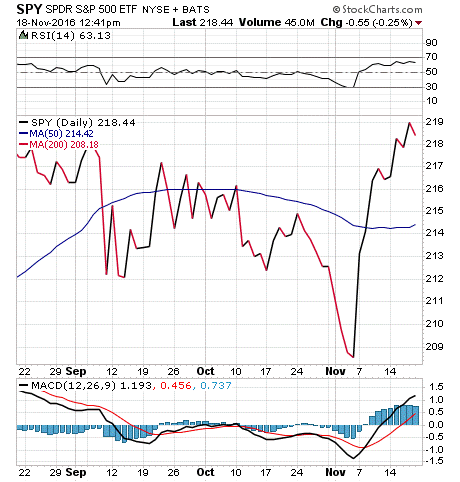

It’s been 10 days since the country elected Donald Trump as its 45th president, and already the markets are adjusting to this new reality.

U.S. equities soared last week, with big gains in “Trump win” sectors such as infrastructure stocks, banks, defense stocks, etc. The gains in these markets have pushed the major indices to near all-time highs.

Meanwhile, there has been a marked rotation out of sectors seen as likely to perform poorly under a Trump administration and a compliant Republican Congress.

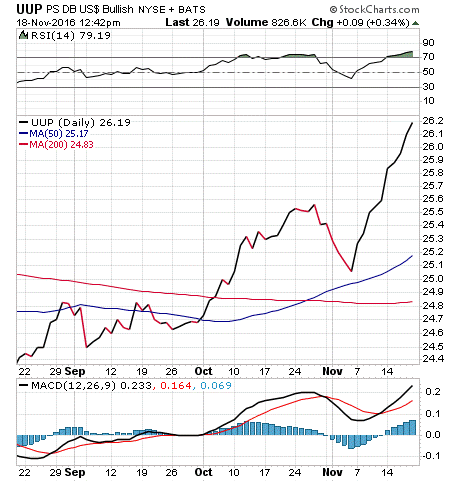

Bond prices have plummeted (and bond yields have risen), as have precious metals, and that’s due to the growing likelihood of higher interest rates and a spike in the value of the U.S. dollar vs. rival foreign currencies.

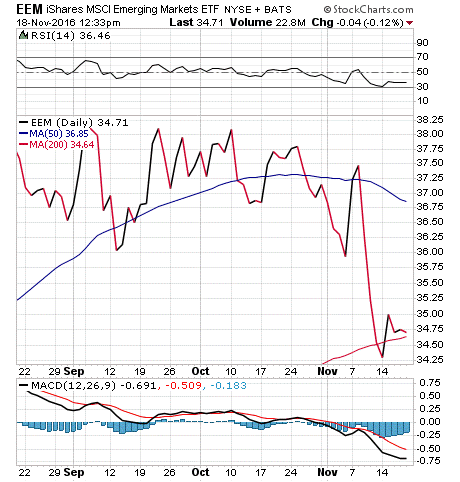

Yet perhaps the biggest exodus we’ve seen since the Trump victory has been in international stocks and, more specifically, emerging market stocks.

In fact, ever since the election results showed the surprise win by Mr. Trump, there has been a lot of trepidation and fear that the tough talk on trade deals, China, Mexico and other foreign competitors would negatively affect these markets.

Those fears now are being priced in, and we can see that from the latest decline in the iShares MSCI Emerging Markets (EEM).

The chart above shows the share price performance of EEM for the past three months. As you can see, the declines have been deep since Election Day, with this benchmark measure of the emerging markets plunging below its 200-day moving average (red line).

Now, since EEM broke below its 200-day average, the fund has clawed its way back above support. Still, there has been a pronounced rotation out of emerging markets and into U.S. stocks… and that’s a trend that investors should recognize and take advantage of.

What this means is that if you hold U.S. stocks, then you have probably benefited from the post-election bounce. If you own international and/or emerging market stocks, then your money probably has been hit.

So, if you own U.S. stocks here, stick with them. If you own foreign and/or emerging market stocks, now is not the time to buy.

I do, however, think that emerging markets will do well in 2017, and right now subscribers to my Successful ETF Investing advisory service have a variety of funds in the emerging market space on their radars and are ready to move in when the opportunity becomes really attractive.

Finally, the Trump equity rotation has prompted me to begin adding positions to the Successful ETF Investing portfolio. So, if you want to get in on the new trades as they come hot off the presses, then I invite you to subscribe to my Successful ETF Investing advisory service, today.

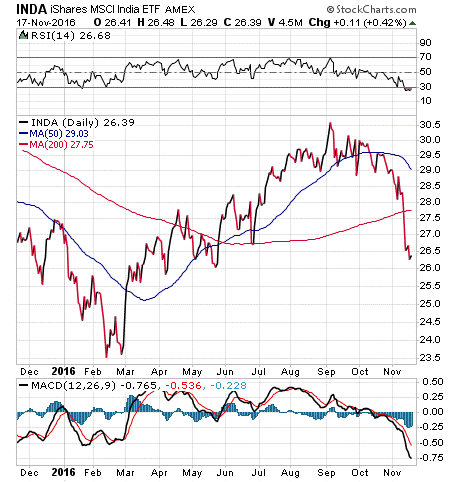

ETF Talk: The Number One Fund Representing India

iShares MSCI India ETF (INDA) is a single-country exchange-traded fund (ETF) that focuses on stocks in India.

With $3.81 billion in total assets, INDA is an undeniably large fund that tracks 85% of the equities in the Indian stock market. All of the ETF’s holdings are large- and mid-cap companies.

The 15% of public companies in India that are “missing” from the fund are the small-cap companies that fund managers chose to skip. As a result, INDA provides a good approximation of the total Indian market.

Since its launch in early 2012, INDA quickly attracted a huge asset base. And even though the fund’s equities trade very frequently throughout the day — which normally would incur higher management fees, administrative fees and other operating costs — the total expense is spread out over a larger base. This ETF’s size, in turn, spreads the fund’s management expenses among more investors and therefore eases the overall burden. The fund is also highly liquid thanks to frequent trading of the shares by the ETF’s investors.

One of the greatest challenges facing INDA is the mismatch in market hours between India and the United States. Since INDA is entirely incorporated in the United States but focuses on Indian markets, intraday valuation of the equities can be difficult and ultimately increases the fund’s operating costs. Fortunately, the fund’s management has kept the expense ratio at only 0.68%. The fund also offers a current dividend yield of 1.40%.

INDA has fared well over the course of 2016 and succeeded in pulling itself to new highs after an initial slow start to the year. Recently, the fund has unfortunately hit a rough patch, as India has entered a period where all of its sectors are showing signs of weakness.

The fund’s return over the last month is -10.58%. However, its year-to-date return is -4.07% versus the S&P 500’s 6.94%.

View the current price, volume, performance and top 10 holdings of INDA at ETFU.com.

The fund’s top five holdings are Housing Development Finance Corp Ltd (HDFC), 8.70%; Infosys Ltd (INFY), 8.03%; Reliance Industries Ltd (RELIANCE), 6.04%; Tata Consultancy Services Ltd (TCS), 4.74%; and ITC Ltd (ITC), 3.80%. The majority of INDA’s holdings are in consumer staples, financials, health care and information technology companies.

If you believe in the strength of India’s growing economy and its ability to rebound from the recent setbacks, I encourage you to look further into the iShares MSCI India ETF (INDA).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

On Strength and Weakness

“The strongest among the weak is the one who doesn’t forget his weaknesses.”

— Danish proverb

While America has elected a seemingly strong individual to be president, I hope that Mr. Trump realizes that real strength comes from recognizing one’s own shortcomings. As the great Clint Eastwood once said… “A man’s got to know his limitations.”

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter article from last week about investors’ immediate reaction to the Trump victory.