A Trump-Bump Breather

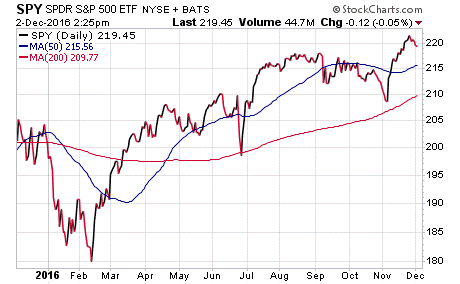

Stocks took a bit of a breather this week, with the first mellowing of the “Trump bump” that occurred after the Nov. 8 U.S. presidential election.

While the major averages were basically flat this week, there’s no doubt that money has been rotating out of sectors such as technology, biotech, utilities, bonds and gold, and into sectors such as financials, industrials, defense and basic materials that are poised to benefit from a Trump-related boost.

Now that we’re into the final month of the year, it will be interesting to see if the Trump rally — and the Trump rotation — will continue. That’s especially true in front of the potential headwinds on the horizon, the first of which is this Sunday’s Italian referendum vote.

If the Italians vote “No” to changes in their version of a constitution, then that could open the door for a Brexit-like move, or an “Ita-leave” as the term du jour goes (i.e. Italy could vote to leave the European Union the way Britain has).

If that happens, it will be very bad for international equity markets, including stocks here at home.

If you’d like to make sure you’re on top of the trends affecting your ETF (exchange traded fund) investments, then I invite you to check out my Successful ETF Investing advisory service, today!

Your Year-End Financial Checklist

The year is nearly over, and that means now is the time to think about what to do with your investments and your current financial disposition.

But the question is, where do you start?

To answer that important point, I’ve put together a short list of steps to take that can get you on the right track to tidy up your current issues in 2016, so that you can be ready to hit the ground running at full sprint in 2017.

1) Review your asset allocation. Do you know what percentage of your money is in stocks, bonds, cash and cash alternatives such as gold or silver? The first step toward knowing where you want to go is to know where you are now.

2) Tax-loss harvesting. If you have some losing, dead-money stocks or ETFs in your portfolio, then now is the time to consider a little tax-loss selling in your taxable accounts. Doing so can take the edge off a big tax bill on April 15.

3) Take advantage of a Roth IRA conversion. A Roth IRA is a great way to keep more of what you have after you retire. In my view, converting a traditional IRA into a Roth IRA might be the easiest way to do that — if you have the right personal situation.

4) Give to those you love. Did you know you could give the gift of Roth IRA to your adult children and grandchildren? Have you setup a 529 education savings plan for your kids or grandkids yet? How about giving to the charity of your choice? Each of these ways can reduce your overall tax burden, and now is the time to give before the calendar turns.

5) Plan your income streams in 2017. Where will you get your income in 2017? Will it be from your job, a business, dividend income, annuities, real estate, etc.? Now is the time to make sure you are clear on how much revenue you’ll have coming in next year. Knowing that will help you plan on how much you can afford to spend, and what you can afford to save.

ETF Talk: Access China’s Top 50 Companies

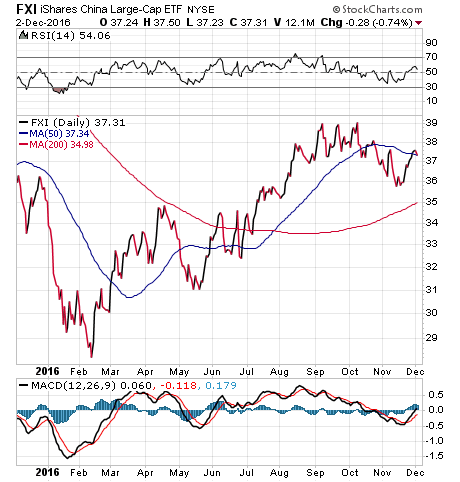

This week’s ETF Talk covers the iShares China Large-Cap ETF (FXI), an exchange-traded fund that focuses exclusively on large companies in China — a quickly rising emerging market country with a gross domestic product (GDP) growing at an annual rate of 9-10% for the last decade.

Since its inception in October 2004, FXI has delivered an annual average return of 11.4%. The fund invests at least 90% of its $3.66 billion in assets in the 50 largest and most liquid Chinese companies whose stocks are actively trading on the Hong Kong Stock Exchange.

This means that U.S.-listed Chinese mega-caps, such as Baidu, Inc., are not included in the fund. FXI is very liquid and has high daily volume. Even so, the fund’s expense ratio of 0.73% is a bit high when compared with its peers.

As far as the fund’s holdings, it carries a heavy focus on China’s financial sector, with 49.1% of its assets invested in the country’s big, state-owned banks. Other sectors the fund concentrates on include communication services, 11%, and technology, 8.5%, which are amongst the fastest-growing sectors in China. The rest of the holdings of FXI are in other sectors, including basic materials, real estate and industrials. The fund is non-diversified.

By investing exclusively in large caps that are either under government control or are of vital importance to China’s economy, FXI manages to sidestep much of the downside risk that small- and medium-sized companies are prone to incur. What FXI is possibly most vulnerable to are the concerns that China’s growth may be slowing.

As you can see from the chart below, FXI has managed a strong overall run in 2016, starting from the lowly $29 range and trading all the way up to $39. The fund recently dropped a bit but appears to be on a path to recovery, as the upward movement towards the end of November indicates. The fund’s year-to-date return is at 6.52%, just slightly below the S&P 500’s rise of 7.59% for the same period. The fund also offers a current dividend yield of 2.71%.

View the current price, volume, performance and top 10 holdings of FXI at ETFU.com.

The fund’s top five holdings are China Construction Bank Corp, 9.00%; Tencent Holdings Ltd, 8.50%; China Mobile Ltd, 7.67%; Industrial and Commercial Bank of China Ltd, 6.25%; and Bank of China Ltd, 5.06%.

If you believe in China’s continual rise in economic power in the years ahead and you are seeking one-stop access to 50 of China’s top large-cap companies, I encourage you to research iShares China Large-Cap ETF (FXI).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

Art of War Wisdom

“Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.”

— Sun Tzu

The great Chinese military strategist is a fountainhead of profundity when it comes to ways to win in life. In this quote, he reminds us that victory is won before the battle is ever fought. In other words, proper preparation is the key to victory in any battle… including the battle to grow your wealth.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter article from last week about how investors’ optimism about the Trump administration is propelling the economy forward.