Is It Time to Pull Up the Brink’s Truck on Gold?

This week, the world watched as a massive hurricane came barreling into the southeastern coast. Yet there was another hurricane of sorts that slammed markets this week, and that was the hurricane of selling in gold and precious metals.

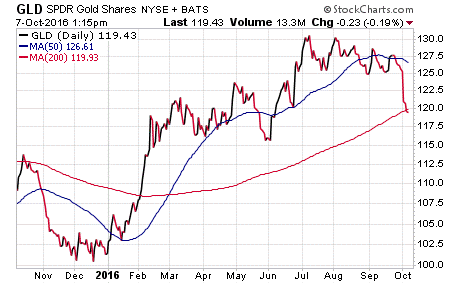

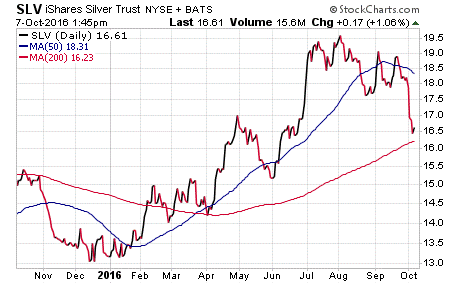

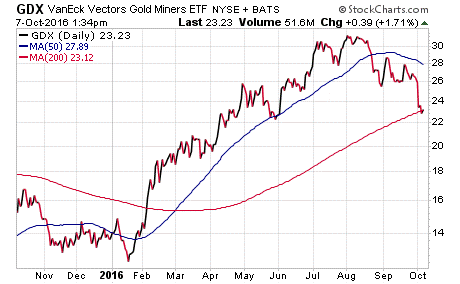

Indeed, gold, silver and gold mining stocks were collectively crushed this week, falling to their lowest respective levels since June and experiencing their worst respective weeks since November 2015.

The reason for the dulling in gold has a lot to do with the very real possibility of a U.S. interest-rate hike in December. Recall that last month, the Fed basically told us that’s what it wanted to do in the statement accompanying the September Federal Open Market Committee (FOMC) meeting announcement.

Well, this week, those rate hike fears actually started to ramp up in earnest. The result was a higher U.S. dollar, as well as a decline in dollar-denominated assets such as gold and silver.

Now, because of the sell-off in gold this week, I’ve had a lot of newsletter subscribers, Weekly ETF Report readers and clients of my money management firm ask me if now is the time to “back up the Brinks truck” and move into gold, silver and gold mining stocks.

My answer here is: Not just yet.

While gold, silver and precious metals miners have fallen back down right about to their respective support at the 200-day moving average, the general sense I get today is that the sellers are still in control.

I want to be patient here and wait for gold to firm up support at the 200-day moving average before adding any exposure to the segment. If this happens, it would represent a nice buying opportunity for gold, silver and the miners going forward.

If, however, we continue to see fear of higher rates and the resultant stronger U.S. dollar push these sectors lower, then obviously an entry into gold, silver or miners here would be premature.

Finally, I know it’s usually a hard thing to know when to get back into a sector after a significant pullback. Knowing how to read the charts and using key technical support areas, such as the 200-day average, can be a huge help, but that’s still probably not going to get you back into a sector that’s corrected at just the right point.

Yet the key here is to not worry about getting in exactly at the right time. As long as you get back in at a discount to where the sectors were trading before the pullback, you are likely to be in good shape for the long run — or at least until the next move higher in these sectors runs out of steam.

If you’d like to find out more about how to use charts, how to determine key technical support levels, and how to put a plan in place that gets you back into markets in time to “back up the Brinks truck,” then I invite you to check out my Successful ETF Investing advisory service today!

ETF Talk: This Emerging Market Fund Focuses on Debt

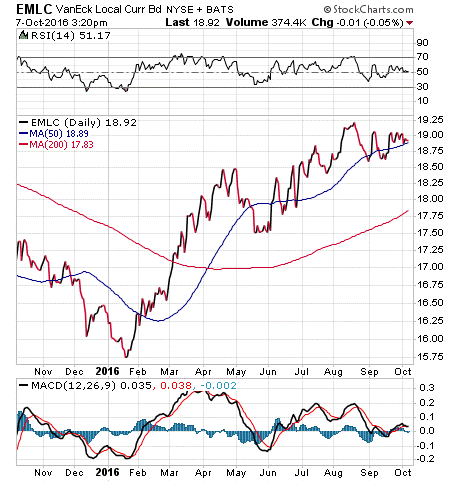

The VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC) is an exchange-traded fund (ETF) with a different focus than most other broad-based emerging markets funds.

Whereas many other funds are focused on investing in the equity markets, EMLC tracks the J.P. Morgan GBI-EMG Core Index, which is comprised of bonds issued by emerging-market governments and denominated in the local currency of the issuer. The fund, with $2.28 million in assets, selects fixed-rate, domestic currency government bonds expiring in 10 years or less from each of the emerging market countries.

Since all of the bonds that EMLC holds are issued by the governments, they carry less default risk (i.e. the risk of a company going out of business) than the typical equity-holding emerging markets fund. However, bonds are more directly affected by interest rate changes than equities, leaving EMLC with a higher interest-rate risk than its equity-holding emerging-market counterparts. Another key difference is that bonds pay guaranteed interest, whereas stocks do not guarantee dividends.

EMLC has had a tremendous year so far, with an overall return of 11.35% versus S&P 500’s 5.79%. There has been considerable fluctuation on the path to that return, however, as the fund’s return dipped by 0.94% just this past month. The fund has a dividend yield of 5.00% and an expense ratio of 0.47%.

View the current price, volume, performance and top 10 holdings of EMLC at ETFU.com.

The ETF’s top holdings are bonds issued by the governments of Chile, Brazil, Indonesia and the Philippines. EMLC is well diversified with a total of 258 positions, with only 14% of assets in its top 10 holdings.

Since EMLC provides investors with exposure to the debt market by purchasing bonds denominated in the local currencies of issuance, it makes the fund susceptible to swings in the foreign currency market. On the other hand, EMLC has balanced geographical coverage and a stable monthly distribution that should appeal to those seeking consistent income from a diverse group of emerging governments.

If these qualities meet your needs and you are comfortable with the currency risk, consider looking into VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

Churchill on Socialism

“Socialism is a philosophy of failure, the creed of ignorance and the gospel of envy, its inherent virtue is the equal sharing of misery.”

— Winston Churchill

The most-excellent British leader framed the struggles of his day in terms of principles, right and wrong and good and evil. If only today’s politicians would follow the Churchill example.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about what Clinton, Trump and Deutsche Bank have in common.