Outsmarting the Billionaire Bear Club

There are a whole lot of billionaires bearish on the equity markets right now.

That bearishness is understandably born out of a sense of unease about this market, a market that’s feeling way too “toppy” and way too overbought.

So, who are these bearish billionaires? Well, the list reads like a who’s who of American finance geniuses.

Here’s a sample of the biggest names who have come out with warnings that this market is headed for trouble, as laid out by the smart folks at Zero Hedge.

- Stan Druckenmiller (May 4 at the Ira Sohn Conference): “Get out of the stock market.”

- George Soros (June 9, as reported in the Wall Street Journal): “The billionaire hedge fund founder and philanthropist recently directed a series of big, bearish investments, according to people close to the matter.”

- Carl Icahn (June 9, on CNBC): “I don’t think you can have (near) zero interest rates for much longer without having these bubbles explode on you” while also saying it’s difficult to assess when exactly that might occur.

- Jeff Gundlach (last Friday, in an interview with Reuters): “Sell everything. Nothing here looks good.”

- Bill Gross (in his monthly investment letter, released last week): “I don’t like bonds. I don’t like most stocks. I don’t like private equity.”

Yes, I’ve heard the old adage that you should never argue about money with anyone richer than you. But the fact is that despite these high-profile bearish calls, they have all been wrong… at least so far.

If fact, being long in this market during its post-Brexit spike has been great for most investors, including subscribers to my Successful ETF Investing newsletter.

One reason we’ve done well of late is because we are letting the trend-following rules of what we call the Fabian Plan dictate what actions we take with our money.

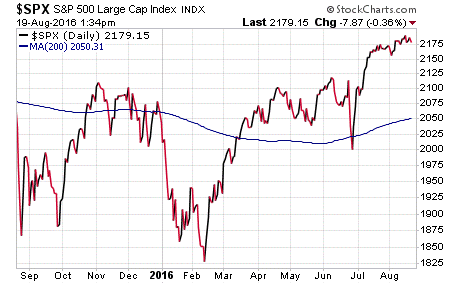

Right now, the plan rules are in “buy” mode, meaning we will continue to hold stocks as they make new highs. If and/or when stocks pull back below key trend support at the 200-day moving average, that will be the time when the market tells us that it’s time to take some risk off of the table.

This trend-following approach is your best way to “outsmart” the billionaire bears, and the beauty of the approach is that it relies purely on objective price analysis. That means you don’t have to second guess the market… you just have to respect its decisions.

Right now, those decisions are sending stocks higher in spite of the warnings from Wall Street’s elite. And until such time as a change needs to be made, we will keep betting on the wisdom of the crowds and keep profiting from the push to all-time highs.

If you want to find out how to put a proven, trend-following plan in place that puts your money to work when things are good, and gets your money on to the safety of the sidelines when things are rocky, then I invite you to check out Successful ETF Investing today.

ETF Talk: Top-Performing Emerging Market Fund Offers Double Opportunity

Global market conditions have made it a difficult year for income investors due to negative interest rates, bullish trends without economic data to support them and uncertainty in normally strong sectors of the market prompting many investors to seek alternative sources of income.

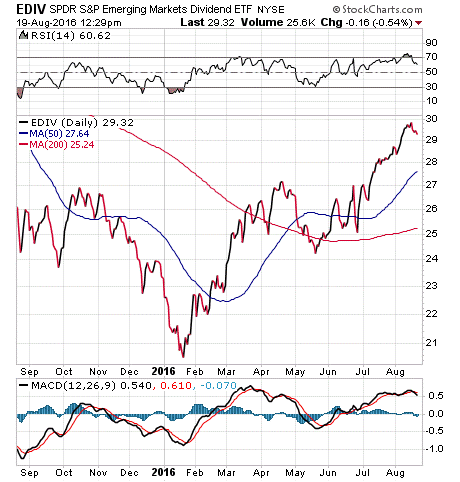

The SPDR S&P Emerging Markets Dividend ETF (EDIV) is an exchange-traded fund (ETF) that gives investors an opportunity to collect dividend payments and to gain access to an improving sector of the global market. The fund is starting to rise, despite emerging markets having been a dark-horse market sector for much of 2016.

After consistently underperforming the S&P 500 for the last several years, emerging markets were not inspiring some investors with confidence. Indeed, certain observers may have dismissed investing in emerging markets altogether early in 2016.

But so far in 2016, the sector’s benchmark, the iShares MSCI Emerging Markets (EEM), has a double-digit percentage return. In addition, dividend-oriented emerging market ETFs have performed even better, with several, including EDIV, up more than 20% year to date.

EDIV tracks a series of 100 high-dividend-paying firms in emerging markets through the S&P Emerging Market Dividend Opportunities Index. The fund is fairly diversified in terms of national origin, with Taiwan (27.82%), South Africa (15.94%) and Brazil (15.41%) ranking as the primary countries in which it invests. Sector-wise, EDIV is heavily focused in financials (28.88%), telecommunications (21.54%) and technology (18.35%).

EDIV currently is up 28% year to date, making it one of the strongest-performing emerging markets dividend funds this year. A 3.5% dividend yield only adds to that impressive gain. The fund has a 0.49% expense ratio and approximately $303 million in assets under management.

The top 10 holdings of EDIV comprise slightly more than 25% of the fund’s total investments. While that may not sound like a large amount, remember that EDIV follows an index of more than 100 companies around the globe and doesn’t have a heavy allocation in any one specific sector or country.

Top five holdings of EDIV include Brazilian transportation company CCR S.A., 3.9% of assets; Turkish steel manufacturer Eregli Demir ye celik Fabrikalari T.A.S., 3.88%; MTN Group Limited, 3.56%; Vodacom Group Limited, 3.04%; and Mobile TeleSystems PJSC Sponsored ADR, 3%.

Stocks and exchange-traded funds (ETFs) with strong dividend yields are in demand right now, make no mistake about it. If you are on the hunt for extra income but also find the idea of an emerging markets play appealing, then you may want to investigate the double opportunity offered by the SPDR S&P Emerging Markets Dividend ETF (EDIV).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

Robbins on Success

“The path to success is to take massive, determined action.”

— Tony Robbins

The motivational guru is a personal mentor of mine, and I love the way he simplifies and clarifies things in the service of achievement. Here, Robbins reminds us that it takes nothing short of a herculean effort if you want to achieve your objectives, and if you want to be truly successful.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my column from last week about what we can take away from the recent new highs in the domestic stock market. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian