The Optimism Force Multiplier

I must admit to my distinct bias toward Thanksgiving as my favorite time of year.

Sure, I love Independence Day and the summer surfing season, but there’s nothing that compares to the nip in the air in November, a big holiday feast and the Christmas season right around the corner.

This time of year is also good for the stock market, as we are firmly in the growth season. Now, this year’s growth season has benefited from something I call “the optimism force multiplier.”

Folks in the country and in the stock market now seem particularly optimistic about the prospects for economic growth due to the incoming Trump administration and a Republican Congress. If the president-elect begins implementing a pro-growth agenda of tax cuts, slashed regulations and infrastructure spending (i.e. fiscal stimulus), then the economy and the markets will likely flourish.

Right now, there is a lot of optimism on that front, and that optimism has been reflected in stocks surging to all-time highs. The Dow now trades about 19,000 while the S&P 500 just passed the 2,200 level.

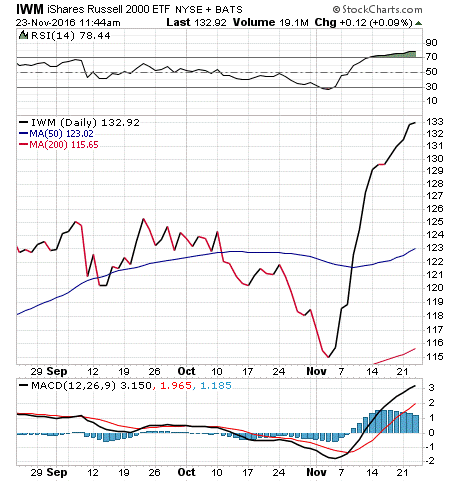

Interestingly, the optimism can really be seen in small-cap stocks, as the Russell 2000 has been one of the biggest beneficiaries of the “Trump bump.”

The chart above shows just how strong the move in small caps has been since Election Day.

That definitely is a reflection of the renewed optimism in the country’s business climate, as investors are betting that the smaller, innovative companies are about to launch along with renewed U.S. economic growth.

This is the “force multiplier” effect of optimism in action, as we have yet to have any policy changes put in place (President-elect Trump doesn’t even take office until Jan. 20).

The bottom line here is that this Thanksgiving, we should be thankful for the renewed optimism in the country, particularly as it relates to the economy and the financial markets.

For investors, this optimism force multiplier is something that you should be taking advantage of right now, as the opportunity in “Trump win” sectors abounds.

If you want to get in on our newest portfolio recommendations, then I invite you to give my Successful ETF Investing advisory service a look over the holiday weekend.

Happy Thanksgiving!

ETF Talk: Senior Brazilian Fund Returns over 63% for the Year

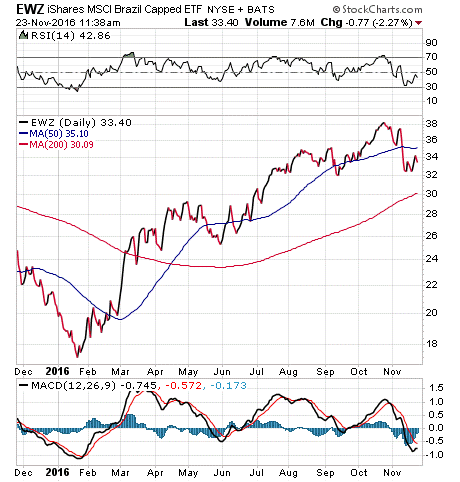

The iShares MSCI Brazil Capped ETF (EWZ), exclusively concentrates on Brazil, the largest country in South America.

With $3.899 billion in net assets, EWZ is one of the powerhouse ETFs in the segment, easily dwarfing its peers in size. Though incorporated in the United States, the fund typically invests more than 95% of its assets in Brazilian companies.

EWZ grants investors exposure to 85% of the Brazilian equities market, using a standard market-cap-weighted strategy that approximates the entire market-cap spectrum, with an inclination towards mid- and large-cap firms. The smaller-cap companies are comprehensively covered by EWZ’s sister fund, iShares MSCI Brazil Small Cap Index ETF (EWZS). When coupled, the two funds provide a full representation of the entire Brazilian market.

Since its inception in July 2000, EWZ has had an overall return of 6.17% over its long track record. As you can see in the chart below, Brazilian stocks experienced a sharp upturn this year.

View the current price, volume, performance and top 10 holdings of EWZ at ETFU.com.

However, after Trump’s surprising presidential victory, the fund suffered a downturn resulting from a large-scale sell-off that affected nearly all emerging market ETFs.

Trump’s tough talk on trade with foreign powers during his campaign has driven fear into the hearts of many investors. But in just the past few days, we can see a stabilization in EWZ’s price as investors have perhaps regained their composure on this issue.

The fund has a dividend yield of 1.59% and an expense ratio of 0.62%, which is relatively cheap among its peers. The fund is highly liquid and has massive trading volume on a day-to-day basis. Possibly in part due to the Rio Olympics, EWZ has a whopping year-to-date return of 63.93%! The S&P 500’s year to date return is 7.78%.

The fund’s top five holdings are Itau Unibanco Holding SA, 11.63%; Bank Bradesco SA Pref Shs, 8.05%; Ambev SA, 8%; Petroleo Brasileiro SA Petrobras 5.47%; and Petrobras, 4.6%;

EWZ is an open-ended fund, meaning investors can get into it with relative ease, since there is no restriction on the total number of shares issued by the fund. Purchasing shares of the fund will simply create new shares.

If you see Brazil as a rising powerhouse in its region, I encourage you to research iShares MSCI Brazil Capped ETF (EWZ) as a possible addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

Thanksgiving Wisdom: On Strength and Weakness

“Birds born in a cage think flying is an illness.”

— Alejandro Jodorowsky

The director, writer, actor, poet and composer lets us know that sometimes, our situation in life makes us think in certain ways that might not be in our best interest. So, this Thanksgiving, try to step outside your own circumstances and see things differently. You might just find that the things you fear most are the things you should embrace.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter article from last week about how you can profit from the massive sector rotations caused by Trump’s victory.