Is This Market Ready for ‘Turning Points?’

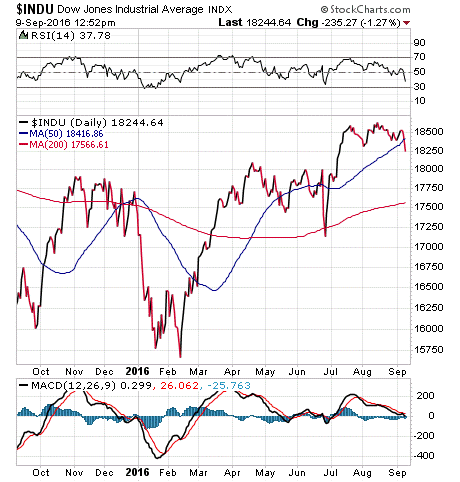

Stocks are down this morning, and down pretty hard. As of midday Friday, the Dow was down some 235 points, or 1.27%, which makes Sept. 9 the worst day for equities since the post-Brexit-vote selloff.

So, why did stocks tumble this morning? Not surprisingly, it was due to Fed speak and fear that the central bank monetary punch bowl is about to be taken away.

Specifically, today’s selloff was a result of comments from Boston Federal Reserve President Eric Rosengren, who said in an interview that the U.S. central bank could resume gradual rate hikes as the risks facing the economy are more in balance.

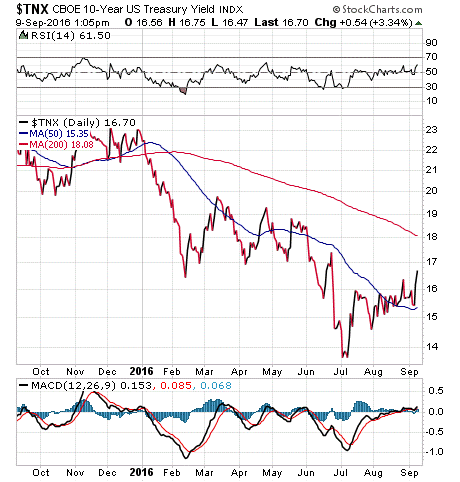

In addition to the selloff in stocks, there was also a selloff in Treasury bonds that sent the yield on the benchmark 10-year Treasury Note up to 1.67%.

Rising bond yields are not good for stocks, but this new normal in the bond market could be one of the “turning points” for investors as we head into the fall.

That’s in part the thesis of bond guru Jeffrey Gundlach of DoubleLine Capital.

Since I am an owner of DoubleLine funds in my money management firm, and we recommend them in the Successful ETF Investing advisory service, I am privy to Gundlach’s webcasts, which are always entertaining.

Yesterday, Gundlach’s presentation outlined a world where interest rates are likely to rise, and where inflation will start creeping higher. Gundlach also said that this is “a big, big moment” for markets, predicting that “interest rates have bottomed.”

The “new bond king” followed up his webcast comments with a much-publicized interview with Reuters. In it, he said that the Fed could raise rates soon just to, “…show that they are not guided by the markets.”

Interestingly, Gundlach also held firm on his political prediction that Republican candidate Donald Trump will be elected president. In fact, part of Gundlach’s theory on why interest rates are going to head higher is his thesis that both Trump and Hillary Clinton have advocated more government spending on infrastructure, otherwise known as fiscal stimulus.

Fiscal stimulus means more debt, and more debt spending. More debt spending, in turn, may increase the cost of government borrowing by adding supply and causing investors to demand higher yields.

According to Gundlach: “People say, ‘How can rates rise?’… That’s how they can rise and they’re sort of rising already.”

If he’s right, today could be looked upon as a turning point of sorts for stocks, the kind of turning point that investors need to know how to cope with. Dealing with these turning points is exactly what my Successful ETF Investing advisory service has been doing for nearly four decades.

Make sure you’re ready for the next turning point in this market by checking out my Successful ETF Investing advisory service, today! Click here for info.

ETF Talk: Check out this Huge, Well-Managed Emerging Markets Fund

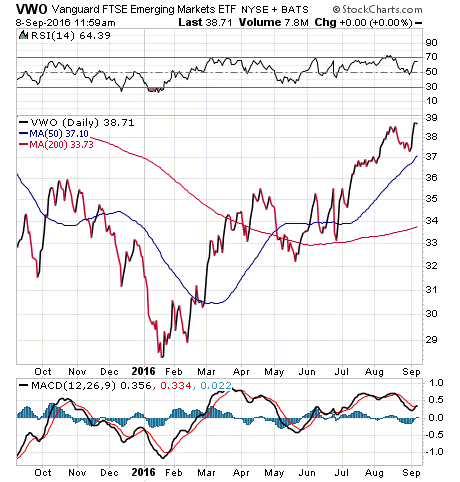

Beginning today, we will turn our attention in this column to a different area of investing — the emerging markets (EM). This week’s EM exchange-traded fund (ETF) pick is the Vanguard Emerging Markets ETF (VWO), a huge, $43.7 billion fund run by Vanguard, one of the largest American investment management companies.

As a quick review, the term “emerging market” is generally used in reference to any country that has some of the characteristics of a developed nation (e.g. the United States), but yet does not quite meet the standards for being considered fully developed. The four largest “emerging” economies in the world are the BRIC countries — Brazil, Russia, India and China.

VWO is a broad ETF, which means that it is pegged to a benchmark index that measures the returns of certain companies located in non-specific emerging markets. As such, VWO provides market-cap-weighted exposure to equities from 22 EM countries, including China, Brazil, Russia, India, Taiwan and South Africa.

Emerging market stocks and funds are notorious for their volatility, as their corresponding national economies are much more prone to big swings than developed economies tend to be. However, here, VWO’s widespread investment strategy gives it an edge over other single-country funds. Rather than any risk an investor assumes when he owns this fund being dependent on the performance of a single country, it is spread out over many different ones.

While emerging markets are volatile, the old saying “nothing ventured, nothing gained” comes to mind, as many EM ETFs have generated impressive double-digit percentage returns in 2016, VWO among them. VWO has a year-to-date return of 15.99%, making it one of the best performing broad EM ETFs amongst its peers. From the chart below, you can see that VWO has experienced a surge in the last three months. The fund has an expense ratio of 0.15% and a dividend yield of 2.35%.

View the current price, volume, performance and top 10 holdings of VWO at ETFU.com.

VWO has considerable holdings in many Chinese companies. Its top holdings are Tencent Holdings Ltd., 3.36%; Taiwan Semiconductor Manufacturing Co. Ltd., 2.38%; Naspers Ltd. Class N, 1.79%; China Mobile Ltd., 1.71%; and China Construction Bank Corporation H, 1.60%.

If you wish to take advantage of the bullish surge in emerging markets this year but don’t want to deal with the increased risk of trying to pick specific foreign stocks, consider looking into the Vanguard Emerging Markets ETF (VWO) as a broad-based addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

On Knowing Yourself, and Your Enemy

“Know thy self, know thy enemy. A thousand battles, a thousand victories.”

— Sun Tzu

The iconic military strategist’s seminal work, “The Art of War,” is replete with lessons about life. Here, Sun Tzu reminds us that the key to victory is not only knowing your enemy, but also knowing yourself. Until you master yourself, you can never really be confident in any of life’s battles.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about how the August jobs report destroyed the chances of a September rate hike. This article, and many other past Weekly ETF Reports, can be found on StockInvestor.com, which is the new home of Eagle Daily Investor. I invite you to bookmark the site and follow it on Facebook and Twitter.

All the best,

Doug Fabian