Is It Time to Pile into Stocks?

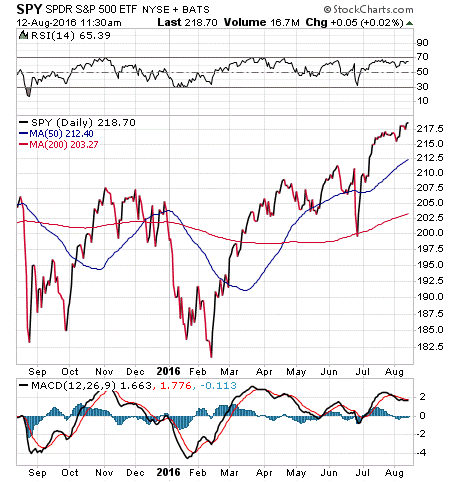

Although it seems hard to fathom, on Thursday the major market averages — the Dow, S&P 500 and NASDAQ Composite — all closed at record highs. The last time that happened was on December 31, 1999.

Yes, we are in a confirmed bull market. The interesting thing, however, is that investors as a whole still remain woefully underinvested. That’s the opinion of Raymond James strategist Jeffrey Saut, who exclaimed as much in a recent CNBC interview.

Like Saut, I’ve spoken with many subscribers to my newsletter, as well as current and potential clients of my money management firm, and the overwhelming feeling I get here is that investors still largely hold high cash positions.

Yet given the current new highs across the board right now, the logical question is whether it is time to pile into stocks?

I think the answer is no.

In fact, if you aren’t already in the market, you need to approach things with extreme caution. There are multiple reasons why, but let me outline a few of the biggest reasons right now.

First, all-time highs are usually followed by at least a modest profit-taking pullback. History makes buying at new highs usually a losing proposition, at least in the short term. I would much rather wait for a pullback off of current levels to start reallocating a lot of capital.

Second, we still have huge headwinds of uncertainty blowing right into the face of this market. Examples include Congressional makeup uncertainty and the biggest uncertainty of all — if Donald Trump is looking increasingly like he’s about to win the election. A Trump win may be good for the economy and markets eventually, but short term, it is going to cause a whole lot of financial market anxiety.

Third, we have the headwinds of seasonality, complacency and too-exuberant sentiment. Seasonally, we are still in the middle of the dog days of summer, a traditionally slow, low-volume time of the year for markets. On the complacency front, we have investors that are not really too worried about a correction. Finally, we have market sentiment that seems far too ahead of itself on the bullish side. In such instances, this usually indicates a turn is near.

Now, one way to approach this market if you are woefully underinvested is to employ a technique that my dad, Dick Fabian, taught me years ago. His solution to the problem of buying at all-time highs, and/or after a market has run up substantially, is a strategy called increment purchasing.

The basic idea here is to take whatever new capital you have on the sidelines that you want to invest, and divide that capital into thirds. The first third can go into the market right now.

After you’ve put that first third to work, if the market moves up less than 5% during the next 30 days, then you should put the next third of that money to work. Apply this formula to the final third of your money, and in 60 days you’ll have put that money to work via increment purchasing.

If, however, the market rises more than 5%, pulls back significantly from your buy point or falls below the 200-day moving average, then you would not put that money to work.

This increment purchasing strategy is perfect for investing when markets are at all-time highs… and when the foundation of those highs is threatened by strong headwinds.

If you want to find out how best to buy into the current new highs in the broad domestic market, and in other markets riding the current bullish wave, then I invite you to check out Successful ETF Investing today.

ETF Talk: This Global Dividend Fund Provides Diversity, Balance

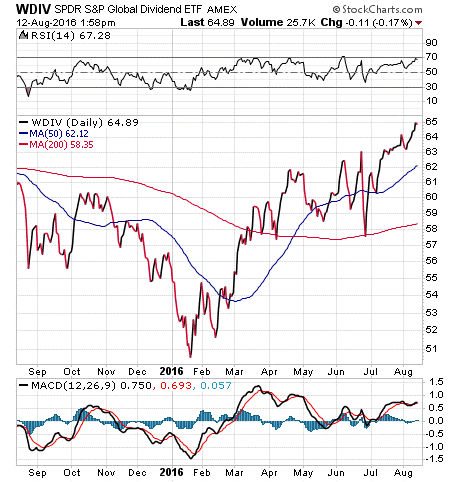

Our series on internationally based income funds continues this week with an examination of the SPDR S&P Global Dividend ETF (WDIV). Some overseas markets have been performing well this year, while others have lagged, but even the markets less favored in the current climate may see a change of fortune.

If you’re willing to take the risk of investing in a sector of the market that still is dealing with the surprise Brexit vote, in which U.K. citizens chose to leave the European Union, then buying shares in a dividend-oriented overseas fund may be a good way to hedge out some of the inherent risk. The dividend aristocrat companies consistently raise their payouts and give the fund a reliable and growing source of income.

In addition, this fund still has some weighting in U.S. companies. In fact, the United States is the country that is home to more positions in WDIV than any other, but only by a slim margin. So, WDIV offers geographic diversification that prevents overweighting in high-risk countries.

It should come as no surprise, in light of the strong performance of American equities during the past few months, that this international fund underperformed the S&P 500 in the last year, with a 1.52% gain compared to 4.83% for the S&P, without including dividends. However, that gap is narrowed when we consider the power of continuous dividend payments.

WDIV offers a dividend yield of more than 4% at present. Total assets for this fund are only $77 million at this time. This means that it is below my recommended threshold for investment, but its strategy is one that is worth bringing to your attention. The expense ratio currently resides at 0.40%, and you can see the recent performance for WDIV in the chart below.

This fund maintains a stable of about 100 holdings. Top positions include Williams Companies Inc., 2.91%; MTN Group Ltd., 2.65%; Enbridge Income Limited Holdings Inc., 1.97%; Fortum Oyj, 1.89%; and Foschini Group Ltd., 1.89%. The top 10 holdings of this fund make up 19.78% of its total investments. The greatest allocations by country are in the United States, Canada and South Africa, but 21 countries are represented in total.

As diversified international funds go, there are a number of interesting strategies to consider. Before you choose the one that is right for you, you may find that researching the SPDR S&P Global Dividend ETF (WDIV) could provide a strong educational foundation.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

On the Power of Word

“He who wants to persuade should put his trust not in the right argument, but in the right word. The power of sound has always been greater than the power of sense.”

— Joseph Conrad

The great novelist made his career by choosing the right words, and here he reminds us of the power of words and sound, especially when it comes to moving a crowd or generating excitement for a cause. Remember this as we enter the final months of the presidential race.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my column from last week about how the latest jobs reports also caused the market to hit new highs. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian