Your First Half Market Scorecard

I’m about to start celebrating one of my favorite holidays. But before we dig into the subject of the day, I’d like to wish you and yours a very happy Fourth of July.

With all of the global unrest, terror threats, economic uncertainties, etc., we have to deal with, it’s important to remember just how lucky we are to be living right now, in the safest, richest and still the freest country ever created.

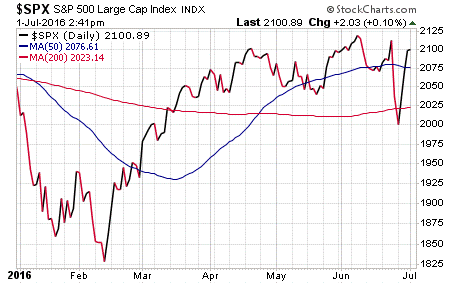

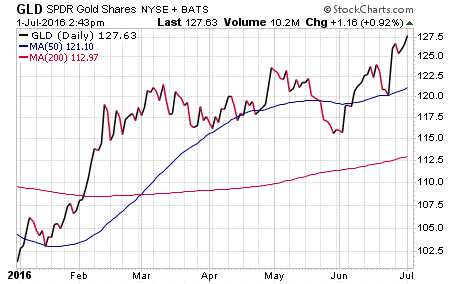

This week, I thought we’d take a look back at the first half of the year, as it has been one marked by a lot of big price swings, a lot of buying in safe-haven assets, and a lot of buying in stocks.

Check out the list here of some of the markets I monitor each day. Here you’ll find the performance data for each respective index, year to date through June 30.

- S&P 500 2.69%

- Dow 2.90%

- Nasdaq -3.29%

- Nasdaq 100 -3.86%

- Gold 24.65%

- Silver 35.44%

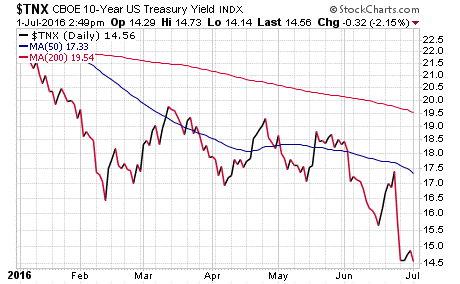

- Treasuries 15.19%

Although there was a decent move higher in large-cap domestic stocks, tech and large-cap tech struggled through the first half of the year. And while stocks generally experienced a back-and-forth first half, it was a different story entirely with safe-haven assets such as gold, silver and long-term U.S. Treasury bonds.

Gold and silver have shined so far in 2016, easily outpacing equities. More significantly, Treasury bonds also outpaced stocks by a wide margin.

It is this boost in Treasury bond prices, one that has pushed bond yields down to record lows on the 10-year Treasury note, that has me feeling more than a bit uncomfortable.

The reason why is because bond yields should not be falling so low when stock prices also are pushing up toward all-time highs. At some point, something has to give. If history is any harbinger of things to come, the bond market will win out over stocks.

In a year that’s been fraught with some big bouts of selling, as well as some big buying, we now are at a place where we expect more volatility to continue.

Election uncertainty, Brexit outcome uncertainty, Fed uncertainty and the like all will help determine what’s next for markets.

And while we can’t be certain of what’s going to happen, we can be reasonably sure that the markets are going to throw us at least a few curveballs along the way.

The only thing we can do, as investors, is to stay in the batter’s box and keep our eyes on the ball.

ETF Talk: A New Breed of Income-Driven Dividend Funds

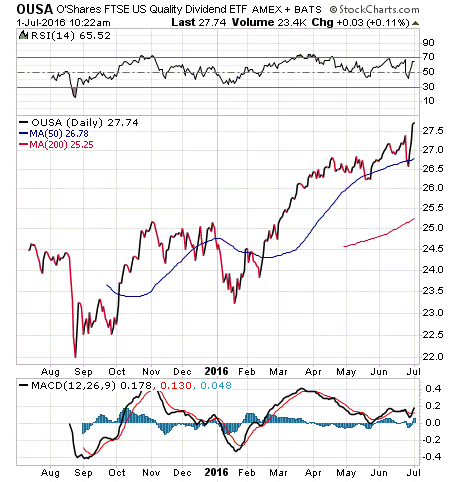

Starting this week, we begin a new series about exchange-traded funds that will focus on income-driven dividend funds. Today’s featured ETF is O’Shares FTSE US Quality Dividend ETF (OUSA), a U.S. fund with total net assets of $209.98 million.

Income-driven dividend funds typically focus on tracking companies that are regular dividend payers, based on certain criteria that vary from fund to fund. OUSA specifically gives investors access to large- and mid-cap U.S. issuers, which are selected based on quality, low volatility and dividend yield.

The high quality and low volatility requirements are designed to cut risk by reducing exposure to companies that may possess high dividend payouts but have endured large price declines.

Since its launch on July 14, 2015, OUSA’s share price has gone up 9.34% to notch a decent gain. Its year-to-date gain of 7.92% significantly outperforms the S&P 500’s 1.79% rise. OUSA has a dividend yield of 2.30%, and its expense ratio is 0.48%. OUSA has shown a fairly stable upward trend in its share price, starting in 2016, based on the chart below.

You likely will recognize most of the top holdings of OUSA. They include Johnson & Johnson (JNJ), 5.37%; Exxon Mobil Corporation (XOM), 5.33%; Verizon Communications (VZ), 4.40%; AT&T (T), 4.29%; and Procter & Gamble (PG), 3.46%.

The fund is fairly diversified, since it holds more than 140 companies in its portfolio. Its top 10 holdings comprise only 37.81% of the fund.

If you are interested in investing in a relatively stable income-driven fund with some of the biggest dividend-paying company names in its portfolio, I encourage you to look into O’Shares FTSE US Quality Dividend ETF (OUSA).

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

On Ambition and Patriots

“The same ambition can destroy or save, and make a patriot as it makes a knave.”

— Alexander Pope

The ambition for freedom, liberty and sovereignty is what fueled the birth of our nation. Yet ambition to achieve a goal can sometimes be toxic, especially if the ends are not sound. Whatever you focus your ambition on, make sure it’s a goal worthy of your life’s blood — because in the end, we are all just what we’ve done.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my column from last week about the significance and ramifications of Brexit. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.

Finally, I invite you to join me at The MoneyShow San Francisco, Aug. 23-25, Marriott Marquis. Register free by calling 1-800-970-4355 or sign up at DougFabian.SanFranciscoMoneyShow.com. Use priority code 041201.

All the best,

Doug Fabian