The Fed’s Hawkish Surprise

The Fed threw the market a curveball this week, as the release of the April Federal Open Market Committee (FOMC) meeting minutes revealed that Janet Yellen and company are indeed willing to hike interest rates again at their next meeting.

That meeting is in June, with another meeting scheduled for July. But could the Fed really hike rates at one or both of these meetings?

Traders are betting against it, but judging by the Fed Funds futures (a way to speculate on future rate hikes) the odds of a June hike have increased markedly. In fact, before the release of the minutes on Wednesday, the Fed Funds futures were indicating only a 4% chance of a rate hike in June. In just the past three days, that probability has jumped to 30%.

The reaction to the hawkish Fed (i.e. more willing to hike rates) from the equity, commodity and currency markets was fast and furious. Stocks plunged, oil and gold prices fell, and the value of the U.S. dollar vs. rival foreign currencies surged.

The gains in the greenback were largely responsible for the declines in oil and gold, as both key commodities are priced in U.S. dollars.

The decline in stocks modulated a bit right after the news, but the S&P 500 still has come under pressure and is now well off the highs of the year.

The broad measure of the domestic equity market now trades below its short-term, 50-day moving average, although we remain well above the long-term, 200-day average.

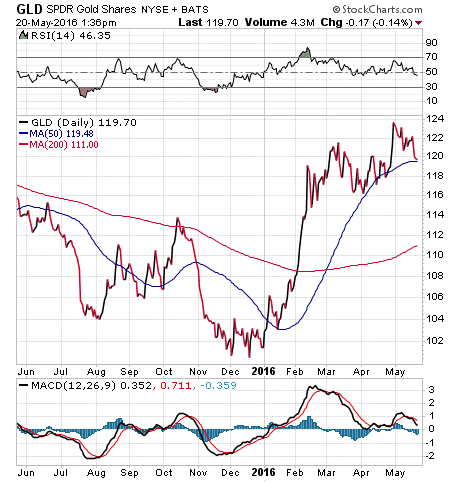

As for the pressure on commodities, we saw gold prices come down as well this week. But as of this writing, the SPDR Gold Shares (GLD) remains above its 50-day moving average.

As you likely know, I am a big fan of gold and precious metals right now. Although this week’s hawkish Fed surprise has taken a bit of luster away from gold, I don’t think this week’s price action is reason to fret.

In fact, May and June are historically poor months for gold. Moreover, despite the recent dollar bounce, there are many more powerful tailwinds that I think can propel gold through the current, Fed-induced choppy waters.

Right now, subscribers to my Successful ETF Investing newsletter are benefiting from gold’s shine, as we’ve recommended several exchange-traded funds (ETFs) in this space that have delivered big for us in 2016.

If you’d like to find out how we are navigating the Fed’s hawkish surprise with our golden sails, then I invite you to give my Successful ETF Investing newsletter a try today.

ETF Talk: Consider Investing in a $7 Billion Gold Mining Fund

For the past several weeks, my ETF Talks have focused on precious metals mining funds that invest in more volatile, potentially risky companies. These funds recently have shown some powerful returns, but likely have more downside risk to them as well.

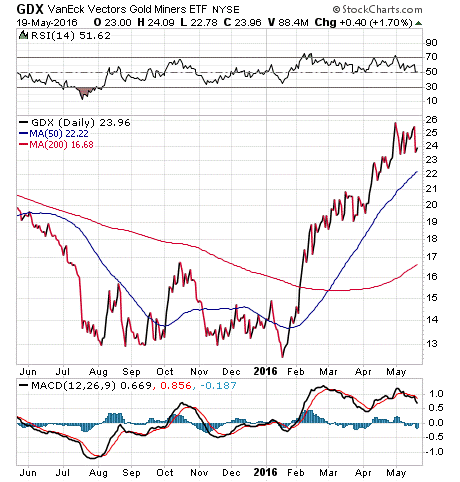

This week, I’d like to discuss an exchange-traded fund (ETF) that invests in a broad range of gold mining companies without any emphasis on smaller ones. This more mainstream fund is the VanEck Vectors Gold Miners ETF (GDX), also known as the Market Vectors Gold Miners ETF.

This fund replicates the NYSE Arca Gold Miners Index, an index of public gold mining companies. Among the fund’s top holdings are the biggest names in the industry. As a result, a large percentage, 55%, of the holdings are in companies originating in Canada. However, GDX does not shy away from companies elsewhere around the globe, and thus has holdings in South Africa, Australia and even Peru.

Although not quite as high-risk as its counterpart GDXJ, GDX’s returns so far this year are nonetheless striking. The fund is up 74% so far this year, an astonishing gain in just under six months. For the same period, the S&P 500 has managed an overall weak performance, clocking in at -0.3%. GDX manages $7.33 billion, making it a big and well-known player in the gold mining ETF field. Its expense ratio is 0.52%.

View the current price, volume, performance and top 10 holdings of GDX at ETFU.com.

GDX is fully invested in stocks. Its portfolio includes Barrick Gold Corp. (ABX), 9.46%; Newmont Mining Corp. (NEM), 7.76%; Goldcorp Inc. (GG), 7.01%; Franco-Nevada Corp. (FNV), 5.22%; and Agnico Eagle Mines Ltd. (AEM), 5.14%. The top 10 holdings of this fund make up 57.07% of its total investments, so while it may not be as diversified as some funds, it is still an improvement over buying a single stock in that regard.

If you want to invest alongside $7 billion worth of other gold investors, VanEck Vectors Gold Miners ETF (GDX) is a simple, no-frills way to accomplish that.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

Gundlach on Failure

“I never thought that we would fail… I didn’t even entertain the idea of failure, because it’s just not a productive activity. Every minute that you spend fretting over success or failure is a minute that you’re not working the business.”

— Jeff Gundlach

The DoubleLine Funds CEO and CIO is someone I admire, and someone whose bond funds I recommend to both my newsletter subscribers and my money management clients. Jeff Gundlach reminds us with this quote that worrying about failure is a sure way to get distracted from the real task at hand, and that is actually to focus on your business. Excellent advice, for sure.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my column from last week about the recent proof of gold’s bullish trend. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian