When Headwinds ‘Emerge’ into Tailwinds

When it comes to investing in the financial markets, you want to have the tailwinds at your back. Moreover, you want to avoid any headwinds, as they can stunt your performance and keep you from reaching your investment objectives.

One segment of the market that’s gone from powerful headwinds to gale-force tailwinds is emerging markets.

Year to date, emerging market stocks in the iShares MSCI Emerging Markets (EEM) have surged nearly 8%. That’s much better than the gains in the S&P 500 this year, and, of course, that far outpaces the declines seen in developed markets such as Japan, Europe and China.

The table below shows the huge relative outperformance of emerging markets this year vs. developed markets.

So, what are the tailwinds powering emerging market sails this year?

First, we’ve seen a stronger U.S. dollar vs. rival foreign currencies, which is bullish for emerging markets. Then there’s the beginning of a move toward higher U.S. interest rates, along with a bottoming of sorts in the commodity space.

Since many emerging markets are commodity producers, a rebound in raw materials also tends to be a bullish tailwind for emerging markets.

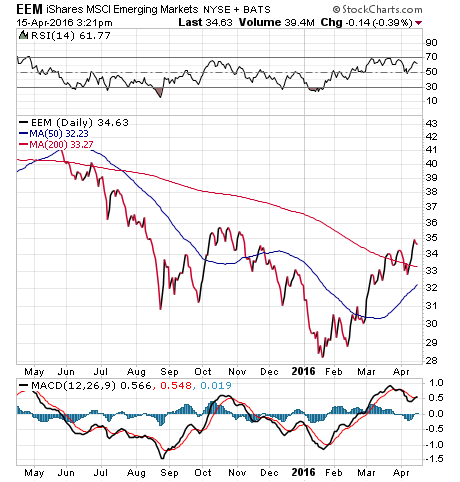

Finally, there’s the extreme overbought status of emerging markets during the past several years. The chart below of EEM shows the steep declines in 2015.

After a three-year bear market in the segment, 2016 has seen the smart money come back into emerging markets. EEM now trades back above its key 200-day moving average — the most-bullish technical tailwind that any sector can receive.

Right now, subscribers to my Successful ETF Investing newsletter are profiting from ETFs pegged to the emerging markets. If you’d like to find out just how we plan to continue riding those tailwinds, then check out Successful ETF Investing today!

ETF Talk: Using Mining Companies to Participate in the Gold Rush

With an overall positive outlook on the gold market at this moment, I feel that it is the perfect time to educate investors about the different types of exchange-traded funds (ETFs) that are focused on or pegged to the precious metal.

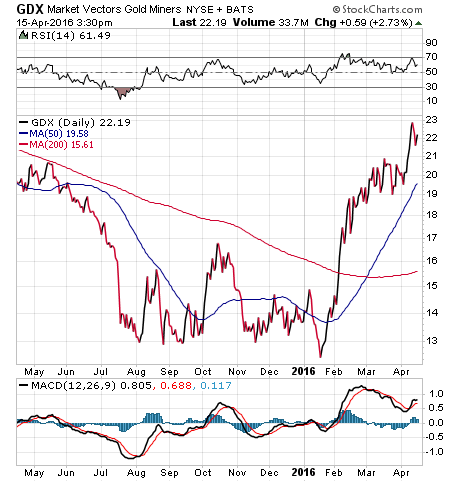

To serve that end, I’ve been shining a spotlight on some of the biggest and best gold funds out there during the last few weeks. This week, I want to present one of the most popular gold funds in the global mining segment, the Market Vectors Gold Miners ETF (GDX).

Rather than focus on the price of gold or the physical possession of gold bullion, GDX’s niche is holding publicly traded companies that are involved in the mining of gold and silver. GDX tracks the NYSE Arca Gold Miners Index, which gives GDX access to almost 30 precious metals mining companies around the globe, including some of the industry’s biggest names, with a nice blend of small-, mid- and large-cap stocks represented.

Note that some of the firms mine other precious metals besides gold, so GDX is not strictly a gold play. Nevertheless, gold is the primary focus of the fund. The resurgence of gold on the global stage has created a kind of monetary flood into related areas and firms, offering a well-timed boost before the encroaching earnings season hits. And mining funds are on the rise, as demonstrated by the 70% jump in GDX’s share price since mid-January.

GDX has more than $6 billion in total assets and an expense ratio of 0.53, plus a small dividend yield of 0.58%.

View the current price, volume, performance and top 10 holdings of IAU at ETFU.com.

As GDX invests in actual companies and firms, it is different from some gold funds I’ve recently spotlighted and I can pass on information about the top holdings in the fund.

Top 10 holdings for GDX make up slightly more than 50% of total assets, and include a lot of familiar names if you follow mining companies. Barrick Gold Corp. (ABX) is the largest holding, with 6.78% of assets. It is closely followed by Newmont Mining Corp. (NEM), with 6.62% of assets, and Goldcorp, Inc. (GG), at 6.27% of assets.

If you’ve been considering investing in a gold fund of late, but find it unnerving that certain gold funds operate without tracking actual companies, then you might feel more at home with the approach of the Market Vectors Gold Miners ETF (GDX).

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

The Market with the Golden Gun

Gold is shining, and both bullion and gold mining stocks are lighting up the scoreboard with outstanding gains so far in 2016.

It is my contention that not only is gold currently immersed in a bull market, but I think there are great reasons to believe that this golden bull will keep running for some time.

Through just the first quarter of the year, the biggest physical gold ETF holding, the SPDR Gold Trust (GLD), is up nearly 16%. That’s a very strong move for any asset class, but particularly for a commodity known more for its hedging properties, as well as its cash-alternative appeal.

Then there’s the action in gold and precious metals mining stocks, as represented by the Market Vectors Gold Miners ETF (GDX). Year to date through April 14, GDX shares have spiked nearly 52%! Yes, you read that right — 52%.

While subscribers to my Successful ETF Investing newsletter have been profiting from these two funds for some time, they are by no means the only ways to take advantage of gold.

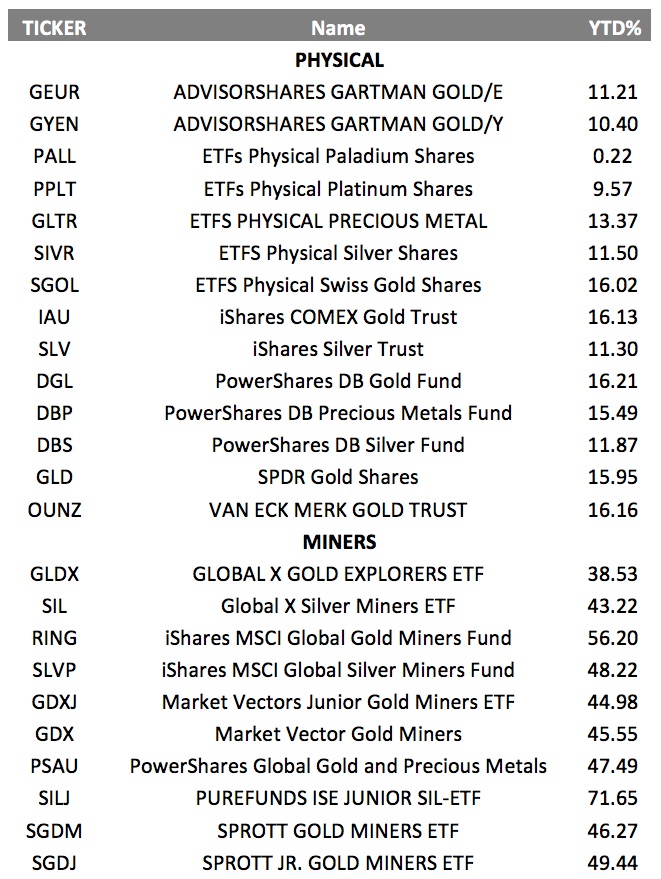

The table below shows some of the best ways to participate in this golden bull market.

Now, we are not suggesting investors pile into all of these funds, but we are showing you how many different ways you now have, thanks to the ETF revolution, to profit from the variety of gold and precious metals mining stock funds out there.

Yet why should you think about gold and mining stocks right now? Well, the way I see it, there are several golden reasons to like the yellow metal and stocks related to it.

First, gold is the ultimate “fear trade,” and right now there remains fear of a global growth slowdown, a China currency and economic collapse, the continued decline in value of the U.S. dollar, and geopolitical tensions abroad. Even election uncertainty here at home has many investors adding a bit of gold to their portfolios.

Then there’s the weakness in currencies around the world, fear of a global debt explosion, central banks around the world experimenting with “negative interest rates,” and even banks waging what I call a “war on cash,” making it hard for people to get cash out of the bank.

Finally, and most importantly, people are buying gold and gold mining stocks, and that’s evidenced by the price action in the sector. Until that price action shows signs of abating, the golden bull will keep on running.

Kobe Wisdom

“I was blessed with talent, but I worked like I had none.”

— Kobe Bryant

I’m a huge basketball fan, and my team is the Los Angeles Lakers. This week, Laker great Kobe Bryant played his final NBA game, going out like a champion by scoring some 60 points while also hitting the winning shot. Now obviously, Kobe Bryant was born with the physical talent needed to excel in his chosen sport. But simply having talent in life isn’t enough.

Kobe knew that if you both had talent and you worked like you didn’t have any talent at all, you could be great. Kobe achieved that greatness. Along the way, he taught us all about the importance of hard work, perseverance and loving what you do. Thanks Kobe, you’ll be greatly missed.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my column from last week about stock swings and gold rallies. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.