Now That Was One Swinging Quarter

If you were to look at the performance data for Q1 on the major U.S. equity averages, you might think it was a typically slow and quiet period for stocks.

Well, if you thought that, you’d be dead wrong.

The first quarter of 2016 was anything but slow and quiet. In fact, the markets went from the worst start to a new year in history to the biggest market rebound since 1933.

The three-month chart below of the S&P 500 shows you precisely what I mean when I call this one swinging quarter.

As you can see, the markets plunged from the outset, tumbling close to bear-market territory on a combination of plunging oil prices, China angst, global slowdown fears and geopolitical tensions.

Then the markets regained some life in mid-February on a combination of rising oil prices, an easing of Chinese and global slowdown fears, and then finally on a “dovish” surprise from the Federal Reserve at the March 16 Federal Open Market Committee (FOMC) meeting.

The table below shows us just how things turned out during Q1 in many of the most prominent major averages, as well as some of the key market sectors we’re watching.

| TICKER | NAME | YTD% |

| SPX | S&P 500 INDEX | 0.77 |

| INDU | DOW JONES INDUS. AVG | 1.49 |

| CCMP | NASDAQ COMPOSITE INDEX | -2.75 |

| IBB | ISHARES NASDAQ BIOTECHNOLOGY | -22.91 |

| XLU | UTILITIES SELECT SECTOR SPDR | 14.65 |

| GLD | SPDR GOLD SHARES | 15.95 |

| USO | UNITED STATES OIL FUND LP | -11.82 |

| EEM | ISHARES MSCI EMERGING MARKET | 6.40 |

| EFA | ISHARES MSCI EAFE ETF | -2.66 |

| AS OF 3.31.2016 | ||

As you can see in the table above, the S&P 500 and Dow ended Q1 in positive territory, albeit slightly, while the NASDAQ Composite still hasn’t brought itself back into the black for the year.

And while some sectors did very well in Q1 (utilities, gold and even emerging markets), other sectors got crushed, including biotech and oil.

The fall in biotech was troubling for markets, as that had been one of the leading sectors in 2015, and one that many predicted would lead markets higher this year.

Nobody thought that gold would regain so much shine this year, but that’s precisely what’s happened to the yellow metal in Q1 (see the ETF Talk below for more on gold).

To me, the resurgence in emerging markets, as seen here in the iShares MSCI Emerging Market ETF (EEM), is one of the biggest developments in this swinging Q1. The reason why is because this is a sector that got pounded in 2015, and one that needed to start coming back if there was going to be a wider global equity recovery.

The rebound in EEM tells me that the smart money is thinking along the same strategic lines as we have been this year, and that’s always a great confirming indicator for your market thesis.

So, will Q2 be as volatile as Q1 was?

We won’t know for certain until another three months has passed, but one thing I think we can say is that investors need to be prepared for just about anything in the coming quarter, as surprise swings such as we saw in the first quarter can happen to markets without notice, and in spite of the best-laid plans of even the smartest participants.

ETF Talk: Take a Stand against Inflation with This Gold ETF

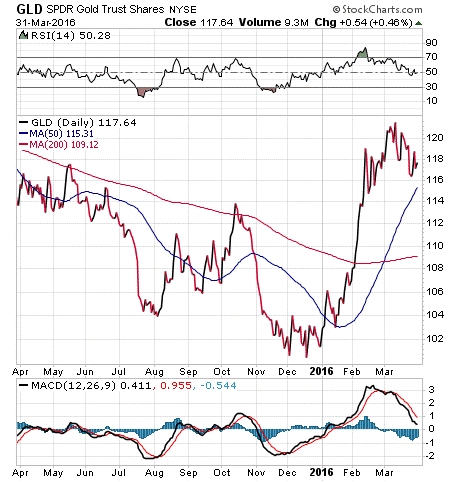

Among various exchange-traded funds (ETFs), I find gold to be one of the most interesting sectors available to investors. Well-known as a safety play and a hedge against inflation, your view on gold and owning it probably depends on what you think about the state of the global economy and inflation in general. One way to invest in gold with a fund that offers good liquidity for an ETF is through SPDR Gold Shares (GLD).

Specifically, GLD holds shares in companies that prospect for or produce gold. The fund allows investors to invest in physical gold bullion without the somewhat daunting responsibility of having to buy and sell it themselves.

Basically, this fund exists to purchase different types of gold bars and hold them in repositories, meaning that GLD’s assets are physically backed up. In terms of assets, GLD is the largest gold fund, with some $32 billion in assets.

In terms of performance, GLD tends to buck the trend of the market, giving it mixed returns over various periods of time. It currently is up nearly 17% year to date, as you can see below. GLD does not pay dividends, and its expense ratio sits at a modest 0.40%.

All of the fund’s top holdings are simply different types of gold bars, and an exhaustive list of precisely what it holds can be found here.

View the current price, volume, performance and top 10 holdings of GLD at ETFU.com.

If you believe, as I do, that the world’s central banks are in an experimental monetary policy of epic proportions and the whole mess could come tumbling down, then your answer is that situation could be to own gold. On the other hand, if you believe all is right in the world, central banks take action with our best interest at heart and all of the bankers are good people, then you probably won’t want to bother.

So, if you’re with me, how do you own gold? The purest play possible on the yellow metal would be to go out and purchase physical gold. But, as our ancestors figured out, it is a lot easier to carry and store thin paper money rather than weighty blocks of precious metals.

If recent market turbulence has shaken your faith in the economy or you are worried about inflation, SPDR Gold Shares (GLD) could be a good contrarian play. From an investment point of view, in terms of liquidity and upside growth potential, I believe ETFs that feature precious metal investments make a lot of sense.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

This Is All You Need

“All you need in this life is ignorance and confidence, and then success is sure.”

— Mark Twain

My favorite writer here was being somewhat jocular, as he often was, yet there is a huge amount of truth to what Twain says here. Sometimes in life, not knowing you can’t do something is as great of an asset as knowing you can do something.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my column from last week about the impact of the Fed’s recent meeting. I also invite you to comment about my column in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian