Central Bank Maneuvers and January Stock Returns

The books are just about closed on what will be remembered as one of the worst months for stocks in a very long time.

In fact, it was the worst start to a year ever for the equity markets, as a toxic cocktail of plunging crude oil prices and global growth concerns sent sellers running for the exits.

Last week, we told you about the intimate relationship between oil prices and the S&P 500. This week, that relationship continued, as oil prices got a nice boost on rumors that OPEC may start to consider cutting production. While that was just a rumor, oil prices held their bid this week, and that helped stocks hold their own during the week.

Despite stocks finishing slightly positive over the past two weeks, the month-to-date performance in 2016 has been horrendous. The table below shows the losses in all of the major market indices, oil, gold and bonds in this dreary January.

| TICKER | NAME | MTD% |

| SPX | S&P 500 INDEX | (6.44) |

| INDU | DOW JONES INDUS. AVG | (6.73) |

| NDX | NASDAQ 100 STOCK INDX | (8.08) |

| EFA | ISHARES MSCI EAFE ETF | (6.65) |

| EEM | ISHARES MSCI EMERGING MKT | (6.28) |

| USO | UNITED STATES OIL FUND LP | (12.45) |

| GLD | SPDR GOLD SHARES | 5.23 |

| TLT | ISHARES 20+ YEAR TREASURY | 5.63 |

The only two asset classes that captured some decent capital were the flight-to-safety plays of gold and long-term U.S. Treasury bonds. That tells you that the smart money is playing it safe, and that you should too.

Meanwhile, this week we saw more central bank maneuvering. First, we had the announcement from the Federal Reserve on interest rates Wednesday. As expected, Janet Yellen and company didn’t raise rates. They did manage to acknowledge the global equity market difficulties in January, and they put language in their statement saying as much.

What the Fed didn’t do was take off the table the possibility of a rate hike in March. In fact, the central bank still is signaling it will raise rates up to four times this year. The market only thinks the Fed is going to raise rates once this year. That means that the Fed and the market are at odds as to just how fast this rate-hike cycle is going to play out — and that could be a big source of trouble for stocks going forward.

Now, another form of central bank maneuvering this week came overnight, as the Bank of Japan lowered short-term interest rates into “negative” territory. That means that the Japanese are going to be charged to put their money in the bank.

The idea here is that people will put capital to work in the economy rather than be charged money to keep it at a bank, and that this will stimulate the economy. So far, negative interest rates in Europe haven’t stimulated the investment or the inflation desired, so I don’t have my hopes up for Japan’s economy.

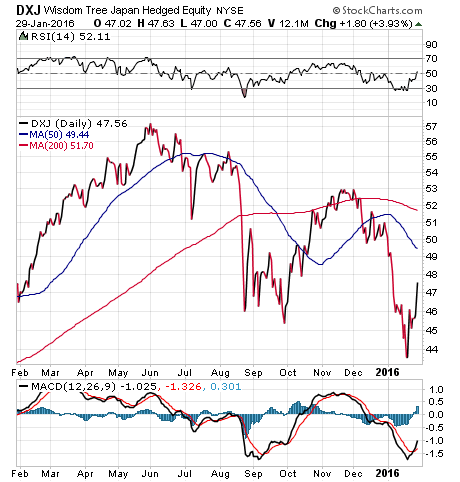

Still, lower interest rates and/or more “QE” (quantitative easing) from central banks are usually bullish for the equity markets in those countries, and today we saw a nice bump in the value of Japanese stocks, as displayed here in the WisdomTree Japan Hedged Equity ETF (DXJ).

The big question now facing investors is whether this market is going to continue down the January path, or whether we will see a rebound in the major averages as earnings season continues.

Given that the market descended into official correction territory early this month, I do think there will be some fast money sloshing around to buy up some beaten-down stocks. However, for any sustainable rally to take place we’ll have to see oil prices climb and global growth forecasts improve. We’ll also have to start see the Fed’s rate hike expectations come in line with the market’s expectations.

Will that happen? We’ll see. How will we know if that happens? We’ll see a rebound in the Fabian Plan metrics showing this market has enough strength to allow us to get back into stocks. Right now, our metrics are telling us to stay away, and they’ve been doing so since early January — before the worst of the selling shocked investors.

If you want to know what are plan is telling investors to do right now, then you need to checkout Successful ETF Investing today.

ETF Talk: Investing in a Broad-Based ETF with Focus

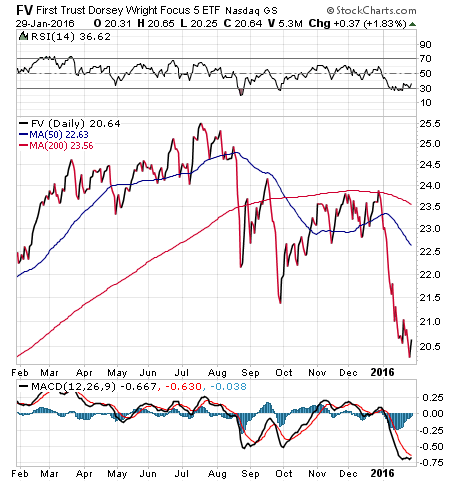

Last week, I began my new series on promising exchange-traded funds (ETFs) for growth-oriented investors with a look at the benchmark health care ETF, XLV. This week, I’d like to move in different direction by featuring the First Trust Dorsey Wright Focus 5 ETF (FV).

FV is a “fund of funds” that reaches into some of the top-performing sectors of the market, including, but not limited to, biotech, Internet, healthcare and consumer staples.

FV uses a “strength model” based on the Dorsey Wright Focus Five Index to make bets in some of the strongest market sectors. First Trust picks five sector- and industry-based ETFs from its list of plays that its fund manager expects to offer the best chance of beating competitor ETFs.

The five ETFs that are chosen then are equally weighted within the fund, with a selected ETF remaining until it drops below the average level of strength. This measure is designed to reduce the number of ETFs rotating in and out of the fund.

View the current price, volume, performance and top 10 holdings of FV at ETFU.com.

A look at FV’s chart for only the first month of 2016 might be a little alarming to some investors, as the fund has fallen more than 10% since the year began. However, with nearly 75% of its investments in health care, consumer cyclicals and technology sectors, FV is on fairly stable ground. It currently is down less than 4% from prices at the end of 2014. FV pays a small dividend yield, only 0.16%, and its expense ratio sits at 0.94%. The fund has nearly $4 billion in assets managed.

As a fund that focuses primarily on its five First Trust sector- and industry-focused ETFs, FV is not as concentrated in its biggest holdings as many other ETFs. FV’s top 10 holdings comprise a mere 13% of the fund’s weighting. The top three are Facebook, 2.17%; Amazon, 2.13% and Nektar Therapeutics, 1.20%.

The five “First Trust” ETFs currently held in FV are: NYSE Arca Biotech ETF, Dow Jones Internet ETF, Health Care AlphaDEX ETF, Consumer Staples AlphaDEX ETF and Consumer Discretionary AlphaDEX ETF.

If you believe that a multi-sector approach is a good way to handle the market right now, then the First Trust Dorsey Wright Focus 5 ETF (FV) could be a good “all-in-one” investment.

Remember to look for the current price, volume, performance and top 10 holdings of FV at ETFU.com.

If you want my advice about buying and selling specific ETFs, including appropriate exit points, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

The Best ETF Ideas for 2016

Over the past several weeks, we’ve covered what I think are the five best ETF ideas for 2016 for both growth investors, and income investors.

Here’s a quick review of all 10 ETFs on our list.

Growth ETFs

1) Health Care Select Sector SPDR Fund (XLV). Health care is an industry that continues benefitting from demographics, innovation, mergers and acquisitions (M&A) deals and insurance mandates. XLV is the ETF that holds the biggest and best health care stocks around.

2) First Trust Dorsey Wright Focus 5 ETF (FV). This is a “fund of funds” that simultaneously holds other funds that have allocations to top-performing sectors. Biotech, Internet, consumer staples, consumer discretionary and health care all are part of this fund.

3) PureFunds ISE Cyber Security ETF (HACK). This is the cyber security stock ETF, one that we’ve written about extensively in this publication, and in the Successful ETF Investing newsletter. We also recently conducted a FREE webinar on HACK, which I encourage you to check out before you start making investment decisions in 2016.

4) iShares India 50 ETF (INDY). India is a country that has a pro-capitalist political climate, a huge amount of human capital and citizens hungry for economic growth and an enhanced living standard. INDY is a way to get exposure to the companies benefitting the most from these trends.

5) WisdomTree Japan Hedged Equity Fund (DXJ). Japan continues to put the pedal to the metal on “Abenomics,” which means more quantitative easing from the Bank of Japan, and likely more upside for Japanese stocks. And, with DXJ’s hedge component you get that performance without the negative influence of any currency disparities.

Income ETFs

1) SPDR DoubleLine Total Return Tactical ETF (TOTL). This bond fund is actively managed by the “New Bond King,” Jeffrey Gundlach of DoubleLine Capital, and it takes advantage of the best bonds in the market. The fund invests across global fixed-income sectors, and with an eye toward shorter-duration bonds.

2) iShares US Preferred Stock (PFF). This fund gives you exposure to the best preferred stocks in the market. These hybrid securities are sort of like stocks, and sort of like bonds, as they tend to move higher with the equity markets while also delivering strong yields.

3) PowerShares CEF Income Composite ETF (PCEF). This ETF “fund of funds” gives you exposure to the closed-end fund market, a market that has consistently delivered outstanding yields for income-oriented investors.

4) iShares US Real Estate ETF (IYR). Real Estate Investment Trusts, or REITs, are a fantastic tool for generating yield, and in this fund of funds you get broad-based exposure to the best REITs operating in the market today.

5) iShares Select Dividend ETF (DVY). This is the best ETF for exposure to the biggest and arguably the best dividend-paying stocks in the market today. DVY gives you a very solid yield along with the upside potential of the broader equity markets.

If you want more ideas, including which funds we’re buying right now, then I invite you to check out my Successful ETF Investing newsletter today!

A Thought on Facts

Get your facts first, then you can distort them as you please.

— Mark Twain

Given that we are just a few days away from the first presidential primary caucuses, I thought it might be helpful to inject a little Mark Twain into the conversation. After all, nobody can distort the facts as well as politicians (regardless of party), so just remember that when you’re casting your vote this year.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about the role central banks are playing in the markets right now. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian