Just another Central Bank Rescue?

Surprise! The market actually saw some green screens this week, a welcome relief from the virtual sea of red through the first dozen or so trading days of the year. And while stocks plunged into official correction territory last week (10% or more off the most recent high), this week’s rebound was both welcome and overdue.

So, what prompted buyers to step back into the market in the past couple of trading sessions?

One reason is Friday’s rebound in crude oil of more than 7% midway through the session. Oil’s precipitous plunge of late really has put pressure on energy stocks, bank stocks and many other large-cap stocks — stocks that all are components of the major market indices such as the benchmark S&P 500.

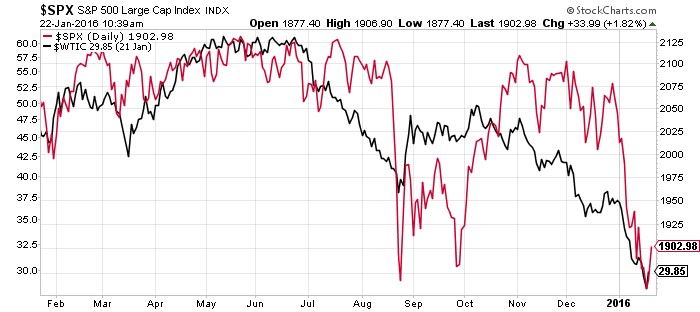

In the chart below, we can see the price of the S&P 500 plotted along with the price of crude oil.

The relationship here isn’t hard to see, even for the most novice chart reader.

As oil goes, so go the prices of U.S. large-cap equities. That means that if oil prices can stabilize here, that will go a long way toward stopping the wider market bleeding.

Another bullish factor helping stocks climb is renewed chatter of more stimulus from central banks around the world.

While the Federal Reserve isn’t likely to do any kind of renewed stimulus, I do expect Janet Yellen and her fellow U.S. central bank leaders to be more “dovish” in their language at next week’s Federal Open Market Committee (FOMC) meeting. There’s also a good chance the Fed will hike rates only one or two more times at most this year. That’s a far cry from the four rate hikes the Fed had signaled it would undertake last December.

Also, rumblings out of both the Bank of Japan (BoJ) and the European Central Bank (ECB) suggesting there could be more quantitative easing (QE) in the months to come has helped buoy rallies in those respective markets as well as here at home.

This week, ECB President Mario Draghi announced he expects the ECB to move on more QE as soon as March. That news helped lift U.S. stocks yesterday, and it’s helping the overall bullish environment today.

So, will this be another case of central banks to the rescue?

Possibly, but given the big selling we’ve seen in 2016, there’s still a long way to go before the major global markets can get some traction.

The table below shows just how beaten-down markets have been year to date.

Finally, I am of the opinion that if we continue to see a bounce in the broad markets, that will be a chance for most investors to sell into strength and reduce equity exposure (if you haven’t done so already). And until this market can break back above key technical resistance levels, the bears will remain in control.

If you’re a subscriber to my newsletter, you’ve already been mostly out of stocks since before the biggest selling took place. If you want to put a proven investing plan in place that tells you when it’s safe to buy, and when you need to sell, then check out Successful ETF Investing today.

ETF Talk: A Healthy Dose of Healthcare

This week begins our series on growth funds that I recommend for investors in 2016. And to that end, I’d like to go back and consider an exchange-traded fund (ETF) that this column discussed not too long ago that focused on a sector that I think has potential to generate strong returns this year.

If you guessed I’m referring to Health Care Select Sector SPDR (XLV), give yourself a pat on the back.

View the current price, volume, performance and top 10 holdings of XLV at ETFU.com.

The index on which this fund bases its holdings includes all S&P 500 stocks classified as health care. This means that it is basically composed of large, blue-chip, relatively stable health care companies. Familiar names fill the list of its top holdings.

Health care has a lot of tailwinds in its favor this year. If the market stops its nosedive, then health care is one of the sectors most likely to recover strongly.

This fund is down 5.33% over the last 12 months, though that situation improves if you take into account the just over $1 it paid in dividends during that time. XLV now is trading well off its 52-week high, and could provide impressive returns if it moved back up to its lofty levels of the not-too-distant past.

Indeed, XLV is a big fund, with assets managed totaling about $13 billion. Its dividend yield is 1.43%. The following chart offers a more complete picture of recent performance.

As a sector fund, this ETF invests all its assets in health care companies. Therein, prominent subsectors include pharmaceuticals, biotech and health care providers and suppliers. Among its largest holdings are Johnson & Johnson (JNJ), 10.44%; Pfizer Inc. (PFE), 7.46%; Merck & Co. (MRK), 5.57%; Gilead Sciences (GILD), 5.14%; and Allergan plc (AGN), 4.80%.

If you believe in the power of blue-chip health care stocks, Health Care Select Sector SPDR (XLV) is a useful tool for investing in a swath of them.

Remember to look for the current price, volume, performance and top 10 holdings of XLV at ETFU.com.

If you want my advice about buying and selling specific ETFs, including appropriate exit points, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

The Best ETF Ideas for 2016

Over the past several weeks, we’ve covered what I think are the five best ETF ideas for 2016 for both growth investors, and income investors.

Here’s a quick review of all 10 ETFs on our list.

Growth ETFs

1) Health Care Select Sector SPDR Fund (XLV). Health care is an industry that continues benefitting from demographics, innovation, mergers and acquisitions (M&A) deals and insurance mandates. XLV is the ETF that holds the biggest and best health care stocks around.

2) First Trust Dorsey Wright Focus 5 ETF (FV). This is a “fund of funds” that simultaneously holds other funds that have allocations to top-performing sectors. Biotech, Internet, consumer staples, consumer discretionary and health care all are part of this fund.

3) PureFunds ISE Cyber Security ETF (HACK). This is the cyber security stock ETF, one that we’ve written about extensively in this publication, and in the Successful ETF Investing newsletter. We also recently conducted a FREE webinar on HACK, which I encourage you to check out before you start making investment decisions in 2016.

4) iShares India 50 ETF (INDY). India is a country that has a pro-capitalist political climate, a huge amount of human capital and citizens hungry for economic growth and an enhanced living standard. INDY is a way to get exposure to the companies benefitting the most from these trends.

5) WisdomTree Japan Hedged Equity Fund (DXJ). Japan continues to put the pedal to the metal on “Abenomics,” which means more quantitative easing from the Bank of Japan, and likely more upside for Japanese stocks. And, with DXJ’s hedge component you get that performance without the negative influence of any currency disparities.

Income ETFs

1) SPDR DoubleLine Total Return Tactical ETF (TOTL). This bond fund is actively managed by the “New Bond King,” Jeffrey Gundlach of DoubleLine Capital, and it takes advantage of the best bonds in the market. The fund invests across global fixed-income sectors, and with an eye toward shorter-duration bonds.

2) iShares US Preferred Stock (PFF). This fund gives you exposure to the best preferred stocks in the market. These hybrid securities are sort of like stocks, and sort of like bonds, as they tend to move higher with the equity markets while also delivering strong yields.

3) PowerShares CEF Income Composite ETF (PCEF). This ETF “fund of funds” gives you exposure to the closed-end fund market, a market that has consistently delivered outstanding yields for income-oriented investors.

4) iShares US Real Estate ETF (IYR). Real Estate Investment Trusts, or REITs, are a fantastic tool for generating yield, and in this fund of funds you get broad-based exposure to the best REITs operating in the market today.

5) iShares Select Dividend ETF (DVY). This is the best ETF for exposure to the biggest and arguably the best dividend-paying stocks in the market today. DVY gives you a very solid yield along with the upside potential of the broader equity markets.

If you want more ideas, including which funds we’re buying right now, then I invite you to check out my Successful ETF Investing newsletter today!

Searching is Half the Fun

“Searching is half the fun: life is much more manageable when thought of as a scavenger hunt as opposed to a surprise party.”

— Jimmy Buffett

I love Jimmy Buffett, and not just for his excellent music. The iconic performer is a huge business success, and he’s someone who you can tell just loves life. Here, he tells us about the virtue of the search, and why that’s a really big part of enjoying the time we have.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about how to deal with the market’s turmoil. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian