Red, and Nothing but Red

The first two weeks of 2016 have crushed just about every investor, and just about every sector out there has seen red, and nothing but red, for nearly all 10 days of this year’s trade.

Stocks now are in a confirmed correction, and many stocks have entered official bear market territory of 20% below the most recent highs. I actually saw a statistic showing that more than half of all S&P 500 stocks are now in official bear market territory.

While the broader S&P 500, as well as the Dow and NASDAQ Composite, have yet to descend into an official bear market, if the selling continues just a little bit more, it may not be long before the grizzlies take official command of Wall Street.

The overall tenor of trading in the first two weeks of the year does not bode well for stock returns, at least in the first half of 2016. Unfortunately, aside from decent jobs data, there aren’t many pieces of good news to give investors hope.

The S&P 500 now is well below its 200-day moving average and near the lows of last August’s plunge, as shown below in the chart of the SPDR S&P 500 ETF (SPY).

Crude oil now has broken down below key support at $30, and the “lifeblood” commodity is telling the financial markets that global growth is flailing and that deflationary pressures are here, right now.

Until there’s some price stabilization in the oil patch, there likely won’t be a bottoming of global equity markets.

Now, as I wrote at the beginning of the year, there are four key exchange-traded funds (ETFs) to watch that will tell us virtually all we need to know about this market.

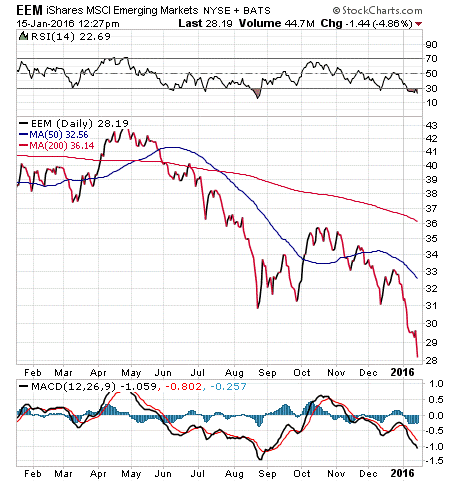

Those ETFs are the DB Commodities Tracking Index Fund (DBC), iShares MSCI Emerging Markets ETF (EEM), iShares FTSE China 25 Index (FXI) and, of course, SPY.

As you can see, a casual glance at each of these sectors is virtually screaming out “bear market!” That situation means now is the time when you want to be out of stocks and on the sidelines holding mostly cash and bonds.

Now, if you were a subscriber to my Successful ETF Investing newsletter, you would have been calm and relaxed in this very tumultuous week. That’s because our proven Fabian Plan gave us a broad-based “sell” signal last week, before the carnage of the past six trading sessions.

Once again, the discipline of a plan that tells you when to exit this market and, just as importantly, when it’s time to get back into stocks is what the Fabian Plan, as well as the Successful ETF Investing newsletter, are all about.

I said this last week, but it’s even more applicable after this week: if this year’s sell-off isn’t enough to get you to put a plan in place, then I don’t know what it will take.

Fortunately, you can check out that plan today in time to avoid any more damage to your hard-earned money.

ETF Talk: A Dividend ETF That Could Help Recover Your Losses

The last exchange-traded fund (ETF) recommendation in this series for income- and dividend-focused investors is the iShares Select Dividend ETF (DVY). DVY is a big player in the land of dividend-focused ETFs, as it gives investors exposure to the biggest and arguably the best dividend-paying stocks in the market today.

View the current price, volume, performance and top 10 holdings of DVY at ETFU.com.

As financial markets struggle to make headway of any sort, dividends are gaining appeal among investors as an alternative way to generate income. DVY tracks the Dow Jones U.S. Select Dividend Index, which is a compilation of broad-cap U.S. companies that are known for their fairly high payouts. In addition, DVY offers exposure to 100 companies that have paid out dividends for at least five years.

Although DVY was down some 5% in 2015 and has lost 3% so far in 2016, the fund’s losses have been far less substantial than some of the double-digit percentage hits many sectors and companies are reporting. This is likely because DVY has significant exposure to both the utilities and consumer staples sectors (35.32% and 12.82%, respectively), which are generally two of the more stable areas of the market.

In addition, DVY’s dividend yield sits at a solid 3.5%, with $13 billion in assets managed and an expense ratio of 0.39%.

While DVY’s total assets largely are invested in positions in the dividend index it tracks, individual holdings are quite small, measuring no more than around 4% each. The fund’s most significant holdings include big-name companies such as Lockheed Martin (LMT), 4.09%; Philip Morris (PM), 2.84%; McDonald’s (MCD), 2.56%; and Clorox (CLX), 2.21%.

If exposure to high-paying dividend stocks seems like a smart way to recover your hard-earned capital right now, the iShares Select Dividend ETF (DVY) could a good first step toward that goal.

Remember to look for the current price, volume, performance and top 10 holdings of DVY at ETFU.com.

Stay tuned for next week, when I will present my first ETF pick in a series aimed at growth-oriented investors!

If you want my advice about buying and selling specific ETFs, including appropriate exit points, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

The Best ETF Ideas for 2016

Over the past several weeks, we’ve covered what I think are the five best ETF ideas for 2016 for both growth investors, and income investors.

Here’s a quick review of all 10 ETFs on our list.

Growth ETFs

1) Health Care Select Sector SPDR Fund (XLV). Health care is an industry that continues benefitting from demographics, innovation, mergers and acquisitions (M&A) deals and insurance mandates. XLV is the ETF that holds the biggest and best health care stocks around.

2) First Trust Dorsey Wright Focus 5 ETF (FV). This is a “fund of funds” that simultaneously holds other funds that have allocations to top-performing sectors. Biotech, Internet, consumer staples, consumer discretionary and health care all are part of this fund.

3) PureFunds ISE Cyber Security ETF (HACK). This is the cyber security stock ETF, one that we’ve written about extensively in this publication, and in the Successful ETF Investing newsletter. We also recently conducted a FREE webinar on HACK, which I encourage you to check out before you start making investment decisions in 2016.

4) iShares India 50 ETF (INDY). India is a country that has a pro-capitalist political climate, a huge amount of human capital and citizens hungry for economic growth and an enhanced living standard. INDY is a way to get exposure to the companies benefitting the most from these trends.

5) WisdomTree Japan Hedged Equity Fund (DXJ). Japan continues to put the pedal to the metal on “Abenomics,” which means more quantitative easing from the Bank of Japan, and likely more upside for Japanese stocks. And, with DXJ’s hedge component you get that performance without the negative influence of any currency disparities.

Income ETFs

1) SPDR DoubleLine Total Return Tactical ETF (TOTL). This bond fund is actively managed by the “New Bond King,” Jeffrey Gundlach of DoubleLine Capital, and it takes advantage of the best bonds in the market. The fund invests across global fixed-income sectors, and with an eye toward shorter-duration bonds.

2) iShares US Preferred Stock (PFF). This fund gives you exposure to the best preferred stocks in the market. These hybrid securities are sort of like stocks, and sort of like bonds, as they tend to move higher with the equity markets while also delivering strong yields.

3) PowerShares CEF Income Composite ETF (PCEF). This ETF “fund of funds” gives you exposure to the closed-end fund market, a market that has consistently delivered outstanding yields for income-oriented investors.

4) iShares US Real Estate ETF (IYR). Real Estate Investment Trusts, or REITs, are a fantastic tool for generating yield, and in this fund of funds you get broad-based exposure to the best REITs operating in the market today.

5) iShares Select Dividend ETF (DVY). This is the best ETF for exposure to the biggest and arguably the best dividend-paying stocks in the market today. DVY gives you a very solid yield along with the upside potential of the broader equity markets.

If you want more ideas, including which funds we’re buying right now, then I invite you to check out my Successful ETF Investing newsletter today!

Real Genius

“A genius is the one most like himself.”

— Thelonious Monk

It is hard to be yourself in a world that demands conformity, rewards compliance and often punishes the man who refuses to accept the status quo. Yet every true genius the world has ever known has done things just a little bit differently. And most often, the real genius of those individuals is that they weren’t afraid to just be themselves.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about the chaos of the start of this trading year. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

All the best,

Doug Fabian